ETFs :The Best Beginner Guide to Succeed

What Are They?

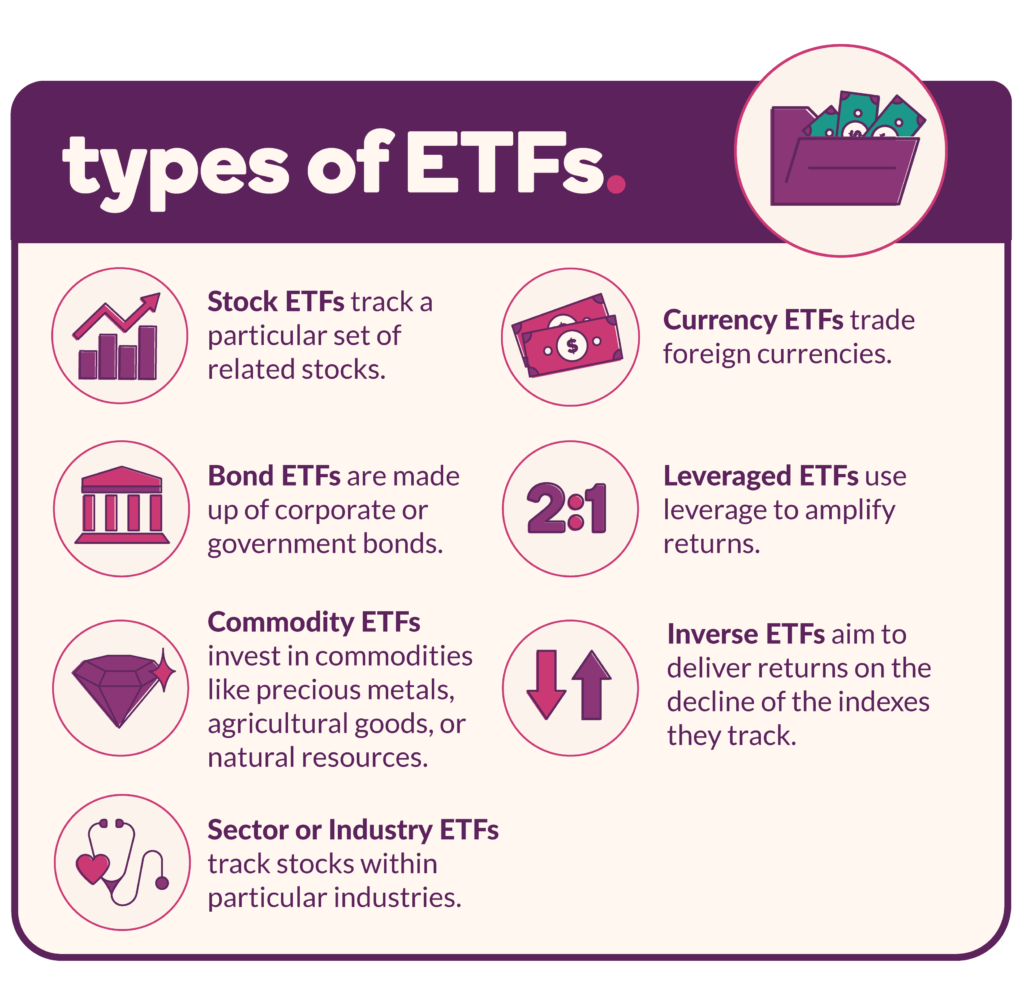

Exchange-Traded Funds, or ETFs, are investment funds that can combine both stocks and mutual funds. These financial instruments are designed to provide investors, with a convenient and easy way to gain exposure to a diversified portfolio of assets, like stocks, bonds, commodities and also real estate !

ETFs are traded on stock exchanges, just like all individual stocks, allowing us to buy and sell shares throughout the trading day at market prices .

(The information provided on this website is for general informational purposes only and should not be considered as financial, investment, or legal advice. Investing involves risk, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with qualified professionals before making any investment decisions.)

How ETFs Work ?

The structure is relatively simple. Here’s how they work:

- Portfolio Composition: An ETF is created and managed by an asset management company. They assembles a portfolio of underlying assets, often designed to track the performance of a specific index, sector, or an asset class. For example, an S&P 500 ETF will aim to mimic the performance of the S&P 500 index.

- Creation and Redemption: In order to create and issue new ETF shares, authorized participants, typically large financial institutions, work with the ETF issuer. They provide a basket of the underlying assets to the issuer in exchange for a specified number of ETF shares. Conversely, they can redeem ETF shares for the underlying assets.

- Trading on Exchanges: Once ETF shares are created, they are traded on stock exchanges, like the New York Stock Exchange (NYSE), NASDAQ or London Stock Exchange (LSE) under a ticker symbol. Investors can choose to buy or sell these shares at prevailing market prices throughout the trading day, just like you would do with individual stocks.

- Arbitrage Mechanism: The ETF prices are closely tied to the NAV ( net asset value )of the underlying assets. Market makers and also authorized participants help ensure that the ETF’s market price closely aligns with its NAV through arbitrage. If the ETF’s market price deviates from its NAV, these participants can step in to buy or sell shares to restore equilibrium.

The Advantages of Investing in ETFs

- Diversification: ETFs provide you with instant diversification because they typically hold a wide range of assets within the single fund. This helps to spread the risk and reduce the impact of a poor-performing individual asset.

- Liquidity: ETFs are also highly liquid, in fact they can be bought and sold throughout the trading day. This liquidity makes it very easy to enter and exit positions, without the risk of the order not being executed.

- Transparency: ETFs allowe us investors to know precisely what assets we own. This transparency improves trust and informed decision-making.

- Low Expenses: ETFs tend to have the lower expense ratios compared to all actively managed mutual funds. So lower expenses can lead to better long-term returns. (Something that we really enjoy )

- Tax Efficiency: ETFs are tax-efficient investment vehicles. They are structured in a way to minimize capital gains distributions, reducing tax consequences for us investors.

- Flexibility: ETFs cover a wide range of asset classes, sectors, and also investment strategies. This provides the flexibility to personalize our portfolio to meet specific goals and preferences.

- Intraday Trading: The ability to trade ETFs throughout the day make them suitable for both short-term and long-term strategies.

ETFs offer several advantages, including diversification, liquidity, transparency, low expenses, tax efficiency, flexibility, and intraday trading, making them an attractive and well-rounded investment vehicle.

ETFs Investment Strategies

1. Long-Term Investing: A long-term investing strategy involves buying and holding ETFs for an extended period, typically several years or even decades. This strategy aims to benefit from the long-term growth potential of the underlying asset of the ETF. (Investors often choose broad-market ETFs or ones that are aligned with their financial goals )

2. Sector-Specific Investing: A sector-specific investing strategy with ETFs focuses on a particular industry or sector of the economy. For instance, you could consider investing in an Energy Sector ETF to gain exposure to companies within the energy industry. This strategy allow you to capitalize on the performance of specific sectors that you believe will outperform the broader market.

3. Index-Specific Investing: An Index-specific investing strategy involves selecting ETFs that track specific market indices. For instance, you can invest in an S&P 500 ETF to mirror the performance of the S&P 500 index or you may choose to invest in a Nasdaq-100 ETF to track the performance of the Nasdaq-100 index. This strategy is very popular because it offers diversified exposure to the entire index, providing a way to match the overall market’s returns and it is less risky .

4. Value Investing: A value investing strategy involves looking for ETFs that contain undervalued assets. If we choose this strategy we aim to purchase assets at a discount, anticipating their value will increase over time. Value ETFs often focus on stocks or bonds that appear to be trading below their intrinsic value (the “true” or “real” value of an asset or investment).

5. Dividend Investing: A dividend investing strategy involve selecting ETFs that focus on stocks or assets with a history of regularly paid dividends. These ETFs can provide a constant stream of income for investors, making them suitable for someone who have an income-oriented strategy, like a retirement portfolio.

6. Tactical Asset Allocation: A tactical asset allocation stratregy involves adjusting periodically your ETF portfolio based on the short-term market conditions. For example, you may increase your exposure to defensive ETFs during economic downturns and shift towards more aggressive ETFs during economic upswings. Suppose the stock market becomes highly volatile due to external factors, like geopolitical tensions. In this scenario, you might decide to increase your holdings in Volatility ETFs, which can help hedge you against market turbulence. These ETFs tend to perform well when uncertainty prevails.

7. Global Diversification: A global diversification strategy involves using ETFs to spread your investments across different countries and regions. Global ETFs or regional ETFs can help mitigate the risk by reducing exposure to a single market or currency.

The choice of strategy depends on individual financial goals, risk tolerance, and investment horizon. Each of these investment strategies using ETFs comes with its own set of considerations, risk profiles, and potential benefits.

ETFs: Fees and Expenses

Understanding the Costs

When you invest in Exchange-Traded Funds (ETFs), it’s very important to be aware of the various fees and expenses that you may encounter. These costs can have a significant impact on your overall returns.

Here are the key fees and expenses to consider:

- Expense Ratio: The expense ratio is an annual fee expressed as a percentage of your investment. It covers the fund’s operating costs, including management fees, administrative expenses, and marketing expenses. Expense ratios can vary widely among ETFs and are a true critical factor to evaluate. (Remember that lower expense ratios generally translate to lower costs for investors, so ….. Yes ! More money that compund for us )

- Commission Costs: Some brokers may charge you a commission or a trading fee when you choose to buy or sell ETF shares. The amount of the commission can vary depending on your brokerage platform and your trading frequency. However, today many brokers offer commission-free trading for a wide range of ETFs, making it more cost-effective for us investors.

- Bid-Ask Spread: The bid-ask spread represents the difference between the buying (bid) and selling (ask) prices of an ETF. It’s a cost incurred when you trade ETF shares. So ETFs with higher liquidity tend to have lower spreads, reducing trading costs.

Impact on Overall Returns: How Fees Matter ?

Understanding how these fees and expenses can impact your overall returns is crucial.

Here’s how they come into play:

- Expense Ratio: The expense ratio directly reduces the returns you earn on your investment. For example, if an ETF has an expense ratio of 0.25%, and your investment gains 8% in a year, your net return after expenses would be 7.75%. Over time, even apparently small differences in expense ratios can significantly erode your returns, particularly for long-term investors.

- Commission Costs: Commissions can eat your returns, especially if you frequently trade ETFs. A solution can be to choose a brokerage that offers commission-free trading for the ETFs you intend to invest in .

- Bid-Ask Spread: The bid-ask spread affects the cost of entering and exiting a position. A wide spread can result in higher transaction costs. To minimize this impact, consider to use limit orders (you specify a price at which you’re willing to buy or sell , and the trade is only executed if the market reaches or surpasses that price) and trading during periods of higher liquidity.

The 5 Best Practices

To optimize your overall returns while managing costs with ETFs, consider the following best practices:

- Compare the expense ratios: Look for ETFs with competitive expense ratios, especially if you plan to hold them for the long term.

- Choose commission-free options: If possible, use brokerage platforms that offer commission-free trading for the ETFs you want to invest in.

- Assess liquidity: Check the bid-ask spread and trading volume to measure the liquidity of an ETF.

- Diversify wisely: Building a diversified portfolio with a mix of low-cost ETFs can help you to strike a balance between risks and costs.

- Review your investments periodically: Periodically review your portfolio and adjust it if needed, in order to maintain your investment objectives while managing the costs.

By being aware of the fees and expenses and also making informed choices, you can really maximize your ETF investment returns over time.

PROS AND CONS OF ETFs

Pros of ETFs

- Diversification: ETFs offer instant diversification by holding a basket of assets within a single fund. This diversification helps spread risk across different investments.

- Liquidity: ETFs are traded on stock exchanges, providing high liquidity.

- Transparency: ETFs disclose their holdings daily, allowing investors to know precisely what assets they own.

- Lower Expenses: ETFs typically have lower expense ratios compared to actively managed mutual funds.

- Tax Efficiency: ETFs are structured to minimize capital gains distributions, reducing tax consequences for investors.

- Flexibility: ETFs cover a wide range of asset classes, sectors, and investment strategies.

- Intraday Trading: ETFs can be traded throughout the day, allowing for better control of entry and exit points.

Cons of ETFs

- Trading Costs: While many ETFs offer commission-free trading, there may still be bid-ask spreads and brokerage fees to consider, especially for frequent traders.

- Tracking Error: Some ETFs may not perfectly track their benchmark indices due to factors like expenses or trading costs.

- Lack of Active Management: Most ETFs passively track an index, so they may not outperform the market.

- Market Volatility: ETF prices can be subject to market fluctuations and can experience price deviations from their net asset values (NAVs) during volatile periods.

- Complexity: While ETFs are generally easy to understand, some specialized or leveraged ETFs can be complex and may not a suitable choice for novice investors.

- Dividend Taxation: The tax treatment of ETF dividends can be less favorable in some cases compared to individual stocks.

- Ownership of Basket: When you buy an ETF, you indirectly own a basket of assets, which may include assets you wouldn’t typically choose individually.

ETFs VS Mutual Funds

Exchange-Traded Funds (ETFs) and Mutual Funds are two popular investment vehicles, each with its own set of characteristics and advantages.

One of the most crucial decisions you’ll face is choosing between Exchange-Traded Funds (ETFs) and mutual funds. If you’re looking for the optimal investment vehicle to suit your financial needs, ETFs should be on your radar. I prefer Etfs to mutual funds because,mutual funds contrary to ETFs have :

1. Higher Costs: Mutual funds tend to have higher costs, including management fees and, in some cases, sales charges. These expenses will eat into your returns over time.

2. Less Trading Flexibility: Mutual funds are priced and traded only once a day, after market close. This limits your ability to react quickly to market changes or emerging opportunities.

3. Limited Transparency: Mutual funds typically disclose their holdings on a monthly or quarterly basis, while ETFs provide daily transparency. You can see that this can make it more challenging for investors to know precisely what the fund holds at any given moment.

4. Tax Inefficiency: Mutual funds may generate capital gains distributions that can have less favorable tax implications for investors, even if they haven’t sold their fund shares.

check ETFs vs STOCKS …

How Much Money do You Need to be Able to Invest in ETFs ?

The amount of money you need to invest in ETFs can vary widely depending on several factors, including the price of the ETF itself, your brokerage account requirements, and your personal financial situation. Here you will find some key considerations :

- ETF Share Price: The price of an ETF share can range from a few dollars to several hundred dollars or more. To buy one share of an ETF, you’ll need at least enough money to cover the cost of that share.

- Brokerage Account Minimums: Many brokerage platforms have minimum deposit requirements to open an account.

- Diversification: Instead of putting all your money into a single ETF, consider spreading your investments across multiple ETFs or asset classes.

- Trading Costs: Be aware of trading commissions or fees charged by your brokerage for buying and selling ETFs.

- Financial Goals: Consider your financial goals and investment timeline. If you’re investing for the long term and can only start with a small amount, that’s perfectly fine.

- Risk Tolerance: Assess your risk tolerance and how comfortable you are with the amount you plan to invest. Don’t invest more than you can afford to lose.

In general, there is no specific minimum amount required to invest in ETFs, and they can be a proper option for both small and large investors.

It’s essential to start with an amount that you are comfortable with and that aligns with your financial goals. As you continue to save and invest over time, you will increase your ETF holdings and build a diversified portfolio that suits your needs.

Final Thoughts

Whether you’re just starting your investment journey or looking to optimize your existing portfolio, the numerous advantages of ETFs make them a valuable addition to any investor’s toolkit. Remember to evaluate your financial goals, consult with professionals if needed, and craft an investment strategy that aligns with your own vision for the future.

If you would like to know more in detail about Exchange-Traded Funds i suggest you a very useful site ( justETF ) that can help you compare, screen and a lot more, in order to find the right ETF for you and start with confidence.

If you are a passionate reader like me and you want to read something more about ETFs , I can suggest you some of my favourite books on the subject. Here are a few :

- All About ETFs” by Richard A. Ferri

- Investing in ETFs for Dummies” by Russell Wild

- ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing” by Lawrence Carrel

This website may contain affiliate links. If you make a purchase through these links, I may earn a commission at no extra cost to you. Your support helps keep this website running. Thank you for your trust !

(The information provided on this website is for general informational purposes only and should not be considered as financial, investment, or legal advice. Investing involves risk, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with qualified professionals before making any investment decisions.)

Recent Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- IPO Explained : How to Start the Right WayIPO explained simply. Ever thought about how companies go from being private to being in the stock market spotlight? It’s through something called an Initial Public Offering, or IPO. It’s like a big debut for companies, with lots of potential…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Penny Stocks vs Crypto : What is the Best Solution ?In this exploration of Penny Stocks vs. Crypto, we will delve into the heart of these investment choices. Penny Stocks and Cryptocurrencies, each of these asset classes carries its own unique set of promises and perils, offering the potential for…