Stablecoin vs Fiat Currency : Who Win This Great Debate ?

In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future.

This exploration dives into the core of the debate, highlighting the differences, benefits, and potential downsides of stablecoins and fiat currencies.

The discussion between stablecoin vs fiat reveals a dynamic story with significant implications for how we understand and use money in the digital era.

Stablecoins Made Easy

Stablecoins:

Stablecoins are special cryptocurrencies made to avoid big price changes, unlike Bitcoin or Ethereum. They’re tied to the value of things like the US Dollar or gold, making them less unpredictable.

How They Work ?

Stablecoins maintain stability by pegging their value to a reserve asset, ensuring a relatively fixed exchange rate.

There are “3 primary types” of stablecoins, each employing distinct mechanisms to achieve stability:

- Fiat-Collateralized Stablecoins:

- Backed by reserves of fiat currency (e.g., USD, EUR) held in a bank account for every unit of stablecoin issued.

- Issuers regularly undergo audits to verify that the amount of fiat held corresponds to the circulating supply of stablecoins.

- Crypto-Collateralized Stablecoins:

- Collateralized by other cryptocurrencies (e.g., Ether or Bitcoin) through smart contracts.

- The smart contracts automatically adjust the supply of stablecoins based on the value of the collateral, maintaining a stable ratio.

- Algorithmic Stablecoins:

- Rely on algorithmic mechanisms to manage the coin’s supply and demand dynamically.

- Smart contracts automatically adjust the supply based on market conditions, aiming to stabilize the price.

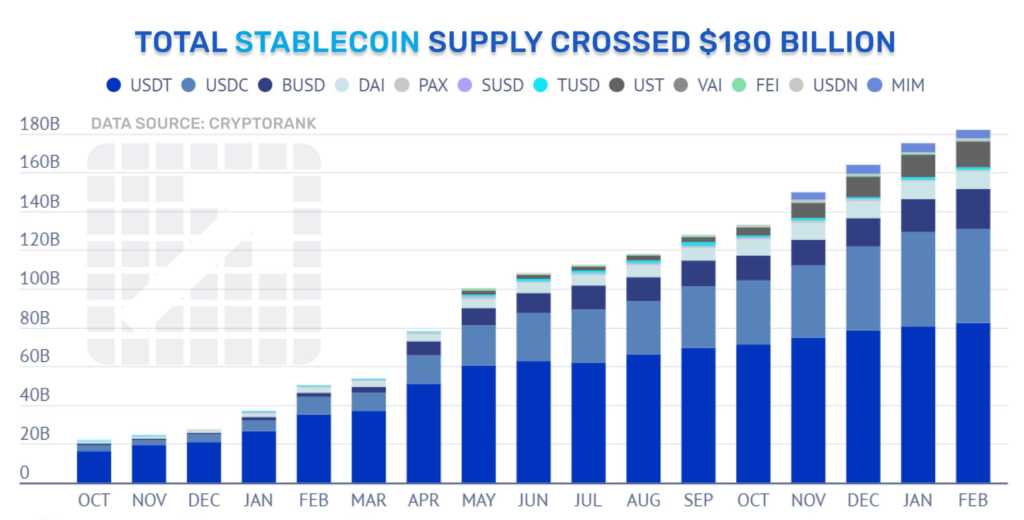

Stablecoins offer users the benefits of cryptocurrencies, such as fast and borderless transactions.

These characteristics make stablecoins an attractive bridge between the traditional financial world and the decentralized realm of cryptocurrencies.

Fiat Currencies: A Brief Historical Overview

Fiat currencies, derived from the Latin word “fiat” meaning “let it be done,” refer to government-issued currencies that are not backed by physical commodities like gold or silver.

Instead, their value is derived from the trust and confidence of the people who use them.

The history of fiat currencies is connected with the evolution of economic systems and the development of modern nation-states.

- Origins:

- Fiat currencies have roots dating back to ancient China, where the government issued paper money during the Tang Dynasty (618–907 AD). However, the concept gained prominence in Europe during the Renaissance and later with the establishment of the Bank of England in 1694.

- Gold Standard Era:

- During the 19th and early 20th centuries, many countries operated on the gold standard. Under this system, the value of a country’s currency was directly linked to a specific quantity of gold held in reserve. This arrangement aimed to provide stability to currencies and limit inflation.

- Abandonment of Gold Standard:

- The gold standard began to erode in the early 20th century, and countries started abandoning it during the Great Depression. The United States officially ended the gold standard in 1971 under President Richard Nixon, ushering in the era of fully fiat currencies.

- Central Banking and Monetary Policy:

- The establishment of central banks, such as the Federal Reserve in the United States and the European Central Bank, became pivotal in managing fiat currencies. Central banks are responsible for monetary policy, including controlling inflation, interest rates, and regulating the money supply.

- Advantages of Fiat Currencies:

- Fiat currencies provide governments with flexibility in responding to economic challenges. Central banks can adjust interest rates and implement monetary policies to influence economic conditions. The lack of a direct link to a commodity allows for greater control over the money supply.

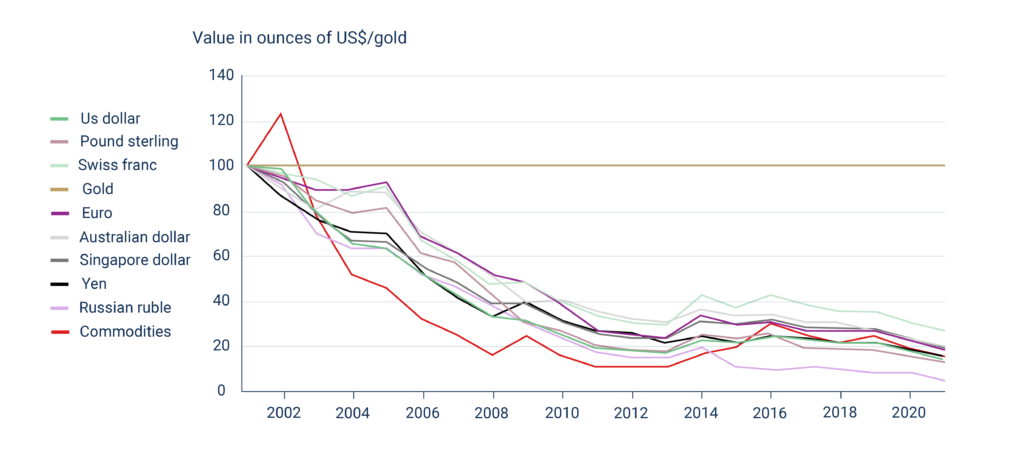

- Challenges and Criticisms:

- Fiat currencies are susceptible to inflation, which occurs when there is an increase in the money supply without a corresponding increase in economic output. Critics argue that this flexibility can lead to currency devaluation and economic instability if mismanaged.

- Global Dominance:

- Today, fiat currencies dominate the global financial system. Major reserve currencies like the US Dollar, Euro, and Japanese Yen are widely used in international trade and finance. The stability and widespread acceptance of fiat currencies contribute to their continued significance in the modern economic landscape.

The historical evolution of fiat currencies reflects the adaptability of monetary systems to changing economic realities. While challenges exist, the widespread use of fiat currencies underscores their resilience and enduring role in facilitating economic transactions on a global scale.

Traditional Banking System and the Role of Central Banks

The traditional banking system is like the backbone of our money world.

Banks do important stuff like taking care of our money, giving loans, and helping with transactions.

When you put money in a bank, they give you a little extra (interest). And if you need money, they can lend it to you.

Banks also make sure things run smoothly when you buy stuff or transfer money.

Then there’s the central bank – the big boss of the banking system. Here’s what they do:

- Make Money: They’re in charge of creating the country’s money and deciding how much is out there. This helps control things like prices and how well the economy is doing.

- Set Rules: They make rules to make sure banks do things right and don’t take too many risks. If there’s a money crisis, the central bank jumps in to keep things from falling apart.

- Help in Emergencies: If a bank is in trouble and might run out of money, the central bank can help out. This keeps people from getting worried about their money.

- Deal with Foreign Money: They also handle money from other countries to make sure our money’s value stays steady in the world.

So, it’s like a team – banks and the central bank working together to keep our money safe and make sure everything goes smoothly.

Stablecoin vs Fiat Benefits

Benefits of Stablecoins:

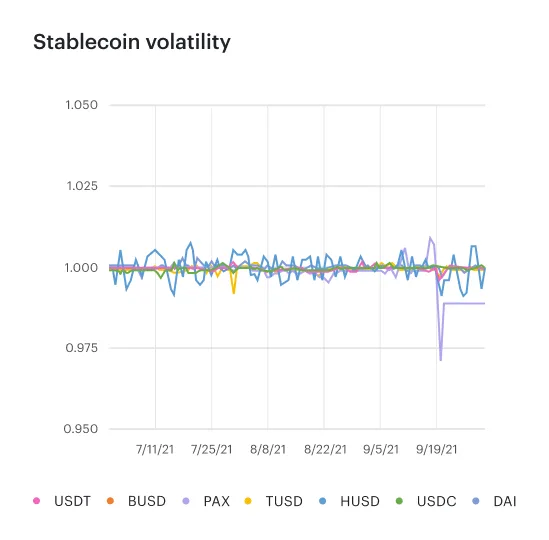

- Reduced Volatility:

- One of the primary advantages of stablecoins is their stability. Unlike many traditional cryptocurrencies, stablecoins aim to minimize price volatility by pegging their value to other assets such as fiat currencies or commodities. This stability makes stablecoins more predictable and reliable for everyday transactions.

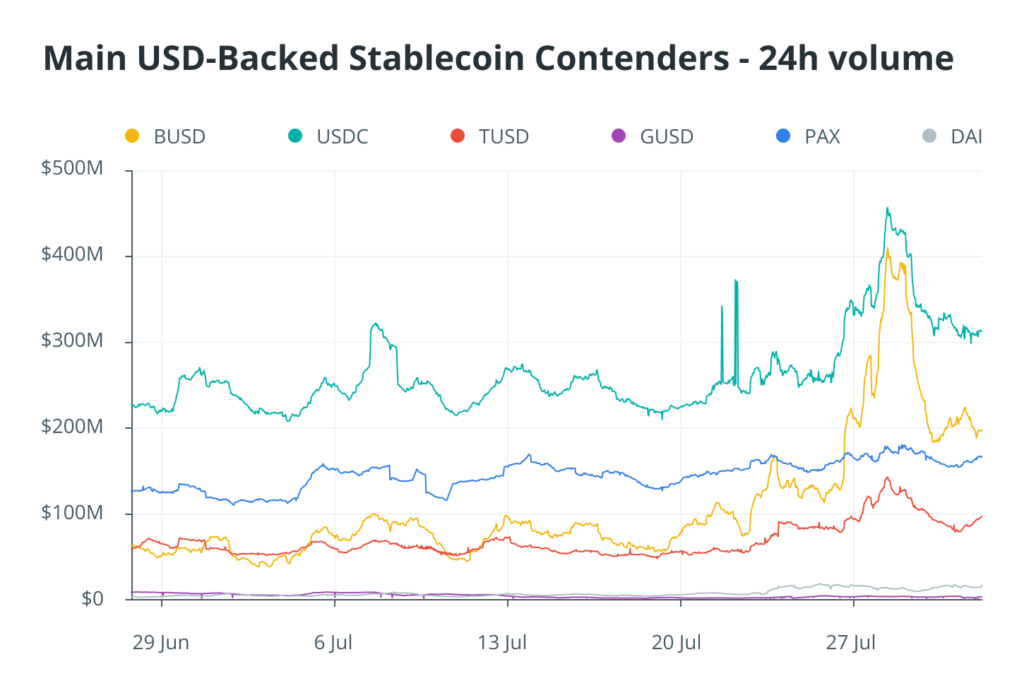

- Efficient Cross-Border Transactions:

- Stablecoins leverage blockchain technology to facilitate fast and cost-effective cross-border transactions. Without the delays associated with traditional banking systems, stablecoins offer a borderless and accessible means of transferring value globally.

- Financial Inclusion:

- Stablecoins have the potential to enhance financial inclusion by providing individuals without access to traditional banking services with a reliable and stable digital currency. This can empower unbanked populations to participate in the global economy and access financial services.

- 24/7 Accessibility:

- Stablecoins operate on blockchain networks, allowing for continuous and decentralized transactions 24/7. This accessibility contrasts with traditional banking systems that may have limited operating hours and face delays in processing international transactions.

- Transparency and Security:

- Blockchain technology, which underpins many stablecoins, ensures transparency and security. Transactions are recorded on a public ledger, providing a transparent and immutable record. This transparency can enhance trust among users and reduce the risk of fraud.

- Privacy Features:

- Some stablecoins incorporate privacy features, allowing users to conduct transactions with a degree of anonymity. While not all stablecoins prioritize privacy, those that do offer users an option to keep their financial transactions more confidential.

- Smart Contract Functionality:

- Stablecoins built on blockchain platforms, such as Ethereum, can leverage smart contracts. This functionality enables programmable features, including the automation of financial processes, lending, borrowing, and decentralized finance (DeFi) applications.

- Reduced Counterparty Risk:

- Fiat-backed stablecoins, which are backed by reserves of fiat currency held in bank accounts, aim to reduce counterparty risk. Regular audits and transparency measures help ensure that the stablecoin is fully backed by the specified reserves, minimizing the risk of insolvency.

- Hedging Against Crypto Market Volatility:

- Traders and investors often use stablecoins as a means to hedge against the volatility of other cryptocurrencies. During market downturns, users can convert their holdings into stablecoins to preserve value, avoiding potential losses associated with cryptocurrency price fluctuations.

- Global Trade and Commerce:

- Stablecoins provide a stable unit of account for global trade and commerce. Businesses can transact with minimal exposure to currency exchange rate fluctuations, reducing the complexity and risks associated with international transactions.

- Decentralized Finance (DeFi) Integration:

- Stablecoins play a pivotal role in the rapidly growing field of decentralized finance (DeFi). They serve as a stable medium of exchange within DeFi protocols, enabling users to participate in lending, borrowing, and other financial activities without exposure to the volatility of non-stable cryptocurrencies.

These benefits collectively contribute to the growing popularity and adoption of stablecoins, positioning them as valuable tools for various use cases within the broader financial ecosystem.

Benefits of Fiat Currencies:

- Widespread Acceptance:

- Fiat currencies, such as the US Dollar, Euro, and Japanese Yen, are universally accepted as legal tender. They are the primary medium of exchange for daily transactions, and their wide circulation facilitates seamless economic activities.

- Government Backing:

- Fiat currencies are typically backed by the government and are considered legal tender by law. This backing provides a sense of stability and confidence in the value of the currency, encouraging trust among users.

- Stability Through Central Bank Intervention:

- Central banks play a crucial role in maintaining the stability of fiat currencies. They can intervene in the market to influence interest rates, control inflation, and manage the money supply, helping stabilize the value of the currency.

- Store of Value:

- Fiat currencies serve as a store of value, allowing individuals and businesses to save for the future. While inflation can erode purchasing power over time, the relative stability of major fiat currencies makes them a preferred choice for savings.

- Legal Tender for Debts:

- Fiat currencies are recognized as legal tender for settling debts, both public and private. This legal status ensures that parties must accept fiat currency as a valid form of payment, adding to its widespread use.

- Government Control and Regulation:

- Governments have direct control over fiat currencies, allowing them to implement monetary policies and economic regulations. This control enables authorities to respond to economic challenges and maintain financial stability.

- Facilitates Monetary Policy:

- Central banks can adjust interest rates and implement monetary policies to manage economic conditions. This flexibility allows for responses to changes in inflation, employment, and overall economic performance.

- Global Reserve Currency:

- Some fiat currencies, like the US Dollar, serve as global reserve currencies. This status enhances their use in international trade and finance, providing stability to the global financial system.

- Supports Government Expenditure:

- Governments can issue fiat currency to fund public expenditures, infrastructure projects, and social programs. This ability to create money is a fundamental feature that supports economic growth and development.

- Accessibility and Familiarity:

- Fiat currencies are widely accessible and familiar to people of all backgrounds. This accessibility contributes to their ease of use in everyday transactions and reduces barriers to participation in the economy.

While both stablecoins and fiat currencies offer unique advantages, fiat currencies continue to be the dominant form of currency in the global financial system, providing stability, legal recognition, and widespread acceptance.

Stablecoin vs Fiat Currency Challenges and Instances of Instability

- Tether (USDT) Controversy (2018):

- Issue: Tether faced scrutiny over concerns regarding the backing of its tokens with US dollars. Questions arose about transparency and the adequacy of reserves supporting USDT’s circulating supply.

- Lesson Learned: Transparency and regular audits are crucial for stablecoin integrity. Users and regulators require clear evidence of sufficient reserves to maintain trust in the stablecoin.

- BitUSD on BitShares (2014):

- Issue: BitUSD, a stablecoin on the BitShares platform, struggled to maintain its peg during market volatility, deviating significantly from its intended value.

- Lesson Learned: Maintaining stability, especially in decentralized systems, is challenging.

- MakerDAO and Black Thursday (2020):

- Issue: MakerDAO faced a critical incident during Black Thursday in 2020, with extreme market volatility causing a drop in the price of Ethereum, collateralizing MakerDAO’s stablecoin (Dai).

- Lesson Learned: Risk management is crucial in decentralized finance (DeFi).

- Iron Finance (2021):

- Issue: Iron Finance witnessed a significant incident in 2021 when its stablecoin, Iron Titanium (TITAN), suffered a severe price collapse, breaking its peg to the US Dollar.

- Lesson Learned: This incident highlighted the risks of algorithmic stablecoins.

Historical Instances of Fiat Currency Challenges and Lessons Learned:

- Hyperinflation in Zimbabwe (2000s):

- Issue: Zimbabwe faced hyperinflation, leading to a significant devaluation of its currency. At its peak, prices doubled every 24 hours, causing economic turmoil.

- Lesson Learned: Prudent fiscal and monetary policies, along with effective governance, are essential to prevent hyperinflation and maintain the stability of fiat currencies.

- Currency Crisis in Argentina (2001):

- Issue: Argentina experienced a severe currency crisis, leading to a default on its debt. The government abandoned its peg to the US Dollar, causing economic upheaval.

- Lesson Learned: Currency pegs require careful management, and unsustainable economic policies can lead to crises. Flexibility and adaptability are crucial for economic resilience.

- The Great Depression (1929-1939):

- Issue: The Great Depression saw widespread economic downturns, impacting global currencies and trade. Unemployment soared, and many countries faced severe economic challenges.

- Lesson Learned: Coordinated international efforts, such as the Bretton Woods Agreement, highlighted the importance of collaboration and effective monetary policies during global economic crises.

- European Exchange Rate Mechanism (1992):

- Issue: The collapse of the European Exchange Rate Mechanism (ERM) saw currency crises, notably in the United Kingdom. Speculative pressures forced some countries to abandon their pegs.

- Lesson Learned: Currency pegs need to be carefully managed, and policies should be adaptable to changing economic conditions. Collaborative efforts are crucial for regional currency stability.

These historical instances underscore the complexities and challenges faced by both stablecoins and fiat currencies.

While stablecoins aim to address volatility through technological means, fiat currencies rely on established economic frameworks and policies to maintain stability.

The lessons learned from these instances contribute to ongoing discussions on the resilience and adaptability of different currency systems.

Stablecoin vs Fiat Insights from Influential Figures

Warren Buffett (Fiat):

- The legendary investor Warren Buffett has expressed skepticism about cryptocurrencies, including stablecoins. He often emphasizes the importance of tangible assets and is known for his preference for traditional investments. Buffett sees fiat currencies as a store of value, and his investment philosophy centers around long-term value and fundamental analysis.

Elon Musk (Stablecoins and Crypto):

- Elon Musk, the influential entrepreneur and CEO of Tesla and SpaceX, has shown interest in cryptocurrencies, including stablecoins. While he has praised the innovation behind digital currencies, Musk has also raised concerns about their environmental impact. His dynamic stance adds a layer of complexity to the discourse, indicating a cautious optimism regarding stablecoins.

Ray Dalio (Fiat and Cryptocurrencies):

- Renowned hedge fund manager Ray Dalio has expressed mixed views on cryptocurrencies. While acknowledging their potential, Dalio has raised concerns about their volatility and regulatory uncertainties. He sees fiat currencies as a crucial part of the global monetary system but also recognizes the need for innovation in financial technologies.

Mark Cuban (Stablecoins and DeFi):

- Entrepreneur and investor Mark Cuban has shown interest in stablecoins and decentralized finance (DeFi). Cuban sees the potential for stablecoins to disrupt traditional finance, providing efficient and accessible financial services. His positive outlook on certain aspects of the crypto space aligns with the ongoing innovation in stablecoin and blockchain technologies.

Christine Lagarde (Fiat and Central Banks):

- As the President of the European Central Bank (ECB), Christine Lagarde plays a key role in shaping monetary policy. Lagarde recognizes the importance of central bank digital currencies (CBDCs) and the evolving landscape of digital finance. Her perspective reflects the delicate balance between embracing innovation and maintaining the stability of fiat currencies.

Michael Saylor (Stablecoins and Bitcoin):

- MicroStrategy CEO Michael Saylor is a vocal advocate for Bitcoin and has also shared positive sentiments about stablecoins. Saylor believes in the potential of digital currencies as a hedge against inflation and has expressed interest in stablecoins that are backed by reserves. His views highlight the diverse opinions within the crypto space.

Bill Gates (Fiat and Digital Transactions):

- Microsoft co-founder Bill Gates has emphasized the importance of digital transactions and financial inclusion. While he acknowledges the significance of traditional currencies in daily transactions, Gates has also shown interest in digital innovations that enhance accessibility and reduce transaction costs.

Catherine Wood (Stablecoins and Blockchain):

- Ark Invest’s founder, Catherine Wood, has been a proponent of blockchain technology and digital assets. Wood sees the potential for stablecoins to revolutionize financial systems, especially in reducing friction in cross-border transactions. Her views align with the broader trend of institutional interest in blockchain-based financial solutions.

Janet Yellen (Fiat and Regulation):

- As the former Chair of the U.S. Federal Reserve and later the U.S. Secretary of the Treasury, Janet Yellen has highlighted the importance of regulating cryptocurrencies. Yellen recognizes the need for a balanced approach, acknowledging the potential benefits of stablecoins while calling for regulatory oversight to address potential risks.

Jack Dorsey (Stablecoins and Financial Inclusion):

- Twitter CEO Jack Dorsey has been a vocal supporter of Bitcoin and blockchain technology. Dorsey envisions a future where digital currencies, including stablecoins, can promote financial inclusion and empower individuals who are underserved by traditional banking systems.

Mario Draghi (Fiat and Central Bank Digital Currencies):

- Former European Central Bank President Mario Draghi has weighed in on the potential issuance of a digital euro. Draghi sees central bank digital currencies (CBDCs) as a means to adapt to the changing financial landscape while emphasizing the stability provided by fiat currencies.

Peter Thiel (Stablecoins and Libertarian Perspectives):

- PayPal co-founder and venture capitalist Peter Thiel has expressed libertarian perspectives on cryptocurrencies. Thiel sees the potential for digital currencies, including stablecoins, to challenge traditional financial systems and enhance individual freedoms. His views often align with the broader ethos of decentralization.

These insights from influential figures underscore the ongoing debate stablecoin vs fiat and diversity of opinions surrounding stablecoins and fiat currencies. While some investors emphasize the stability and familiarity of fiat currencies, others see the potential for innovation and efficiency in the growing stablecoin ecosystem.

Final Thoughts on Stablecoin vs Fiat

Relevant Resources for Further Reading on Stablecoin vs Fiat:

- Bank for International Settlements (BIS) – Understanding Stablecoins

- International Monetary Fund (IMF) – The Rise of Digital Money

- Financial Stability Oversight Council (FSOC) – Report on Stablecoins

- World Economic Forum (WEF) – Stablecoins: Risks and Benefits

Stablecoin vs Fiat Book Recommendations:

- “The Age of Cryptocurrency: How Bitcoin and Digital Money are Challenging the Global Economic Order“ by Paul Vigna and Michael J. Casey.

- “The Basics of Bitcoins and Blockchains“ by Antony Lewis.

- “The Bitcoin Standard: The Decentralized Alternative to Central Banking“ by Saifedean Ammous.

- “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money” by Nathaniel Poppe.

- “The Ascent of Money: A Financial History of the World“ by Niall Ferguson.

After reading these books, you will certainly have a better understanding of which side to take in the Stablecoin vs Fiat debate.

Stay Engaged:

For the latest insights on stablecoins, fiat currencies, and the evolving financial landscape, subscribe to our social media channels and website updates. Join the conversation, stay informed, and be part of the future of finance.

📷 Dive into our world behind the scenes on Instagram!

📘 Like and connect with us on Facebook!

🎥 Join the fun and creativity on TikTok!

Related content

Subscribe to our newsletter for exclusive content, expert analyses, and regular updates on the topics shaping the financial world. Your journey into the future of finance starts here.

Recent Posts