What is the Most Secure Stablecoin of 2023 ?

We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin.

The cryptocurrency market is in constant evolution and with new players entering the scene, security has become an essential aspect of choosing the right stablecoin.

By the end of this post, I hope that you’ll be well-equipped to make an informed decision about where to anchor your crypto assets for maximum security in 2023.

What Are Stablecoins ?

Stablecoins are a category of cryptocurrencies designed to provide stability in value, in contrast to the price volatility commonly associated with traditional cryptocurrencies like Bitcoin, Ethereum and Cardano.

Their primary purpose is to serve as a reliable and less volatile store of value.

They achieve this stability by being backed by or algorithmically linked to assets with stable values, such as fiat currencies or commodities. So let’s see what types of stablecoins are there.

The Birth of Stablecoins:

Stablecoins emerged as a response to the high price volatility that characterizes most cryptocurrencies. While Bitcoin and other digital assets offered many advantages, their fluctuating prices made them less suitable for everyday use as currencies.

The first stablecoin, Tether (USDT), was introduced in 2014. It was initially pegged to the US Dollar and operated on the Bitcoin blockchain using the Omni Layer protocol. Tether aimed to provide a stable store of value and facilitate transactions within the cryptocurrency market.

Over time, other stablecoins with varying mechanisms and reference assets were developed to address different use cases. Some stablecoins are backed by actual reserves of the reference asset, some use a combination of collateral and algorithms, while others rely purely on algorithmic mechanisms to maintain their stability.

Stablecoins have become a crucial part of the cryptocurrency ecosystem, providing a way to reduce volatility and facilitate practical use in areas like decentralized finance (DeFi), trading, and remittances. Their development continues, and new stablecoins with innovative features and mechanisms are regularly introduced to meet the evolving needs of the crypto market.

Most Secure Stablecoin (+BONUS)

USD Coin (USDC) is one of the well-regarded and widely adopted stablecoins in the cryptocurrency ecosystem. As of my last knowledge update in January 2022, here’s some information about USDC:

USD Coin (USDC):

- Type: Fiat-collateralized stablecoin.

- Peg: USDC is typically pegged 1:1 to the US Dollar, meaning one USDC is equivalent to one USD.

- Issuer: USDC is issued and managed by regulated financial institutions and follows strict compliance measures.

- Transparency: USDC is known for its strong commitment to transparency. Regular attestations are provided by accounting firms to verify that USDC tokens are fully backed by USD reserves.

- Regulatory Compliance: USDC complies with U.S. regulations and operates under the oversight of U.S. financial authorities.

- Use Cases: USDC is widely used for various purposes, including trading, investments, remittances, and as a stable store of value.

- Liquidity: USDC is highly liquid and is available on a wide range of cryptocurrency exchanges and platforms.

USDC is trusted by many users in the cryptocurrency space due to its regulatory compliance, transparency, and reliability in maintaining its peg to the US Dollar. It has been a popular choice for traders and investors who seek a stable asset within the volatile crypto market.

Binance USD (BUSD):

- Type: Fiat-collateralized stablecoin.

- Peg: BUSD is typically pegged 1:1 to the US Dollar, meaning one BUSD is equivalent to one USD.

- Issuer: Binance USD is issued and managed by Binance, one of the world’s largest cryptocurrency exchanges.

- Transparency: BUSD is known for its transparency, with regular audits to ensure that the issued tokens are fully backed by USD reserves.

- Regulatory Compliance: BUSD adheres to regulatory requirements and operates within the framework of Binance, which is known for its strong compliance measures.

- Use Cases: BUSD is used for trading, investments, and as a stable store of value within the Binance ecosystem and beyond.

Tether (USDT):

- Type: Tether offers multiple types of stablecoins, including fiat-collateralized (e.g., USDT-USD) and crypto-collateralized (e.g., USDT-ETH).

- Peg: Most commonly, USDT is pegged 1:1 to the US Dollar, meaning one USDT is equivalent to one USD.

- Issuer: Tether Limited is the company behind USDT.

- Transparency: Tether has faced some controversy and regulatory scrutiny regarding the transparency of its reserve holdings. While it has taken steps to address these concerns, there have been periodic questions about the level of backing.

- Use Cases: USDT is one of the most widely adopted stablecoins and is used for trading, investments, and as a means to move funds within the cryptocurrency ecosystem.

Both BUSD and USDT are used for similar purposes in the cryptocurrency market, such as trading and as a stable means of transferring value. Users often choose between them based on their preference for a particular platform or their trust in the issuer.

You might be wondering, out of these three, which one is the most secure stablecoin to hold in my portfolio?

You should bear in mind that, despite some stablecoins being considered reliable and secure, there is no “perfect stablecoin,” and there are always risks associated with using these digital assets.

Diversifying your portfolio is a wise practice to mitigate risk. Additionally, it is crucial to avoid stablecoins with a dubious or problematic reputation.

So, the smartest move is not to put all your eggs in one basket but to diversify among each of the three.

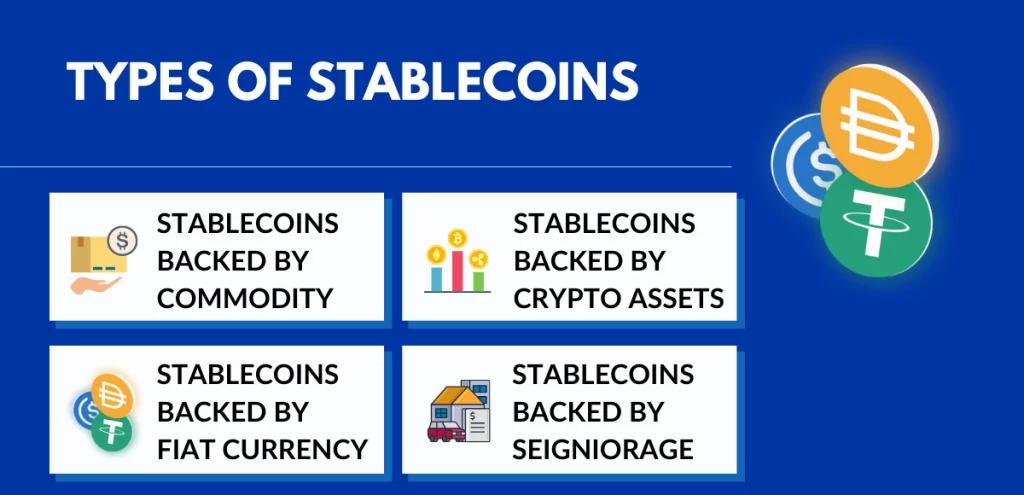

Types of Stablecoins

There are several types of stablecoins, each with its own mechanism for maintaining a stable value. The three most common types are:

- Fiat-Collateralized Stablecoins:

- These stablecoins are backed by a reserve of fiat currency, such as the US Dollar, Euro, or another commonly used currency. In simple terms, you need to know that for every stablecoin in circulation, there is an equivalent amount of fiat currency held in reserve.

- Examples: Tether (USDT), USD Coin (USDC), and TrueUSD (TUSD) are well-known examples of fiat-collateralized stablecoins.

- Crypto-Collateralized Stablecoins:

- These stablecoins are backed by a reserve of other cryptocurrencies. Users lock up a certain amount of a cryptocurrency, like Ether (ETH) or Bitcoin (BTC), as collateral, and stablecoins are minted against the value of the locked assets.

- Examples: DAI, a stablecoin on the Ethereum blockchain, is collateralized with Ethereum itself. An other example could be sUSD .

- Algorithmic Stablecoins:

- Algorithmic stablecoins do not rely on collateral but instead use algorithms and smart contracts to manage their supply. These algorithms adjust the coin supply based on market demand to keep the stablecoin’s value stable.

- Examples: Ampleforth (AMPL) and Terra (LUNA) are algorithmic stablecoins that adjust the supply daily or in real-time based on market conditions.

Each type of stablecoin has its advantages and disadvantages. Fiat-collateralized stablecoins provide a high level of stability but rely on centralized reserves.

Crypto-collateralized stablecoins offer decentralization but may face issues when the collateral’s value drops.

Algorithmic stablecoins aim to balance these factors with algorithmic control but can still experience fluctuations in value.

The choice of stablecoin often depends on the specific use case and risk tolerance of users within the cryptocurrency ecosystem.

Criteria for Evaluating the Most Secure Stablecoin

Evaluating the security of stablecoins is crucial to make informed investment and usage decisions. Here are key criteria used to assess the most secure stablecoin that you should “ALWAYS” check:

- Collateral Backing:

- Collateral should be easily verifiable and of stable value.

- Auditability:

- Transparent and regular third-party audits of both the collateral and the stablecoin’s smart contracts are critical.

- Team Transparency and Governance:

- Understanding the stablecoin’s development team and governance structure is essential. (You want to see a transparent and reputable team)

- Reserve Management:

- For fiat-collateralized stablecoins, the management of the reserve funds is important. How reserves are stored, whether they are insured, and how easily they can be audited or redeemed are all factors that you should take in consideration.

- Regulatory Compliance:

- Regulatory compliance varies by jurisdiction and can impact the security of a stablecoin. Compliance with relevant financial regulations and licenses can provide stability and mitigate legal risks.

- Market Capitalization and Liquidity:

- A stablecoin’s market capitalization and liquidity are indicators of its stability. A more significant market cap and liquidity can help maintain the coin’s peg and reduce the likelihood of large price fluctuations. (So if you want to find the most secure stablecoin, you should prefer one that is well capitalized and that have liquiduity)

- Smart Contract Security:

- The security of the smart contracts that manage the stablecoin is crucial. Vulnerabilities in the code can lead to exploits, which can undermine the coin’s stability.

- Adoption and Use Cases:

- The adoption and use cases of a stablecoin can influence its security. Stablecoins used in decentralized finance (DeFi) or other real-world applications demonstrate their utility and can indicate a more secure ecosystem. (In fact you should stay away from those stablecoins that have no utility at all ! )

- Historical Performance:

- Reviewing the historical performance of a stablecoin can provide insights into its ability to maintain stability. (You can check for past fluctuations and how the coin has responded to market pressures.)

- Transparency and Reporting:

- You should have access to up-to-date information about the stablecoin’s operations. If not, STAY AWAY !

- Community and Reputation:

- The reputation and support of the stablecoin within the cryptocurrency community can be an indicator of security. Positive sentiment and active community involvement can contribute to trust. ( So if there’s a good community, that is active and support the project, the stablecoin can be considered secure, obviously it should have passed all the other criteria )

When evaluating the security of the most secure stablecoin, it’s important to consider these criteria holistically and conduct thorough research.

The cryptocurrency market is dynamic, and stablecoins may evolve over time, so staying informed and up-to-date is crucial for you to make informed decisions.

StocksDeals™ Books Recommendations

If you want to delve deeper into the world of cryptocurrencies, especially stablecoins, and if you, like me, enjoy reading, I can recommend some books that I hope you will find helpful.

(#Amazon ADV)

- “Mastering Bitcoin: Unlocking Digital Cryptocurrencies” by Andreas M. Antonopoulos:

- This book provides an in-depth understanding of Bitcoin and cryptocurrencies, including the core concepts applicable to stablecoins.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar:

- An insightful guide that covers a variety of cryptoassets, with dedicated chapters on stablecoins and their significance in the crypto ecosystem.

- “The Basics of Bitcoins and Blockchains” by Antony Lewis:

- This introductory book explains the fundamentals of cryptocurrencies, including key concepts that apply to stablecoins.

- “The Truth Machine: The Blockchain and the Future of Everything” by Paul Vigna and Michael J. Casey:

- This book explores the disruptive potential of blockchain technology and cryptocurrencies, including the roles of stablecoins.

(#Amazon ADV)

Related Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- The Best Crypto Defi to Have NowHave you ever felt like you were at a crossroads in the crypto universe, surrounded by many DeFi projects, each promising to be the next big thing? Trust me, you’re not alone. We’ll provide you with an up-to-date list of…

- The Best And Powerful GPUs for MiningIn the world of cryptocurrency, the demand for mining, particularly with the best and powerful GPUs for mining, has surged exponentially. Cryptocurrency mining involves the process of verifying and recording transactions on blockchain networks, and it has garnered significant attention…

- The Best Way to Mine Crypto with ComputersWhether you’re driven by the allure of Bitcoin, Ethereum, or the multitude of altcoins, your journey starts here. “The Best and Powerful Crypto Mining Computers” is your gateway to an exciting world of digital wealth Whether you are a seasoned…

- The Best Crypto Tracker to Use NowInvesting in cryptocurrencies offers immense potential, but managing a diverse portfolio can be daunting. Imagine having a comprehensive solution that simplifies tracking and enhances your understanding of your investments. So we have provided to you withe the top list of…

- The Best Crypto Exchanges Platforms of 2023As we explore the best crypto exchanges platforms, you’ll soon realize the strategic advantage of holding more than one account. By embracing multiple accounts, you empower yourself to tap into different features, trading pairs, and unique offerings across various platforms….

- The Best Crypto To Buy Now and Hold ForeverIn the dynamic world of cryptocurrencies, where there is potential for substantial gains , it’s essential to address the risks associated with investments, even when considering those “The Best Crypto To Buy Now and Hold Forever.” The allure of promising…