The Best Free Compound Interest Calculator (CIC)

Our free compound interest calculator is not just a convenient tool; it’s an indispensable asset for individuals engaged in financial planning and investments.

Its accuracy, efficiency, and ability to provide real-time insights empower you to make better financial decisions, set and achieve your goals, and secure your financial future with confidence.

Remember that the longer your money remains invested or saved, the more powerful the impact of compound interest becomes.

Compound Interest Calculator with Chart

How to Use the Free Compound Interest Calculator ?

Using our free compound interest calculator is simple and straightforward.

Here are step-by-step instructions on how to use it:

- Input the Principal Amount: Start by entering the initial amount of money you are saving or investing. (This is known as the “principal amount.” It’s the money you begin with.)

- Enter the Annual Interest Rate: Input the annual interest rate, expressed as a percentage. (This is the rate at which your money will grow over time.)

- Specify the Time Frame: Indicate the number of years you plan to save or invest your money. (This is the “time in years” during which your investment will grow.)

- Calculate the Result: Click or press the “Calculate” button on the calculator. The tool will process your inputs and provide you with the total amount you will have at the end of the specified time frame.

- Review the Results: Examine the results to understand how your money will grow over time.

- Explore Different Scenarios (Optional): If you wish to see how changes in the principal amount, interest rate, or time frame impact your results, you can enter different values and recalculate.

Here’s why a free compound interest calculator is important:

1. Accuracy and Precision: A specialized compound interest calculator eliminates the risk of errors and provides precise, accurate results. (Human errors are common when performing these calculations manually, and even a minor mistake can have a significant impact on your financial planning.)

2. Time-Saving: Compound interest calculations can be time-consuming when done by hand. Using a calculator automates this process, saving you valuable time and allowing you to focus on other things.

3. Real-time Insights: A compound interest calculator enables you to make informed decisions on the spot. (By inputting current interest rates and variables, you can quickly assess the potential growth of your investments and adapt your financial strategy as needed.)

4. Scenario Analysis: A compound interest calculator empowers you to explore various “what-if” scenarios, such as adjusting your monthly contributions, changing interest rates, or different investment durations. (This flexibility helps you make well-informed decisions that align with your financial goals.)

5. Goal Setting: Whether you’re saving for retirement, a child’s education, or a major purchase, using a calculator allows you to set specific financial goals. (It helps you determine how much you need to save or invest to reach these objectives.)

6. Investment Evaluation: For investors, a compound interest calculator is an essential tool for evaluating the potential returns on various investment options. (By inputting different interest rates and timeframes, you can compare the performance of different investment opportunities and select the ones that best align with your financial objectives and risk tolerance.)

7. Confidence in Decision-Making: A calculator provides you with the information you need to make informed decisions with confidence, knowing that you’re basing your choices on accurate calculations.

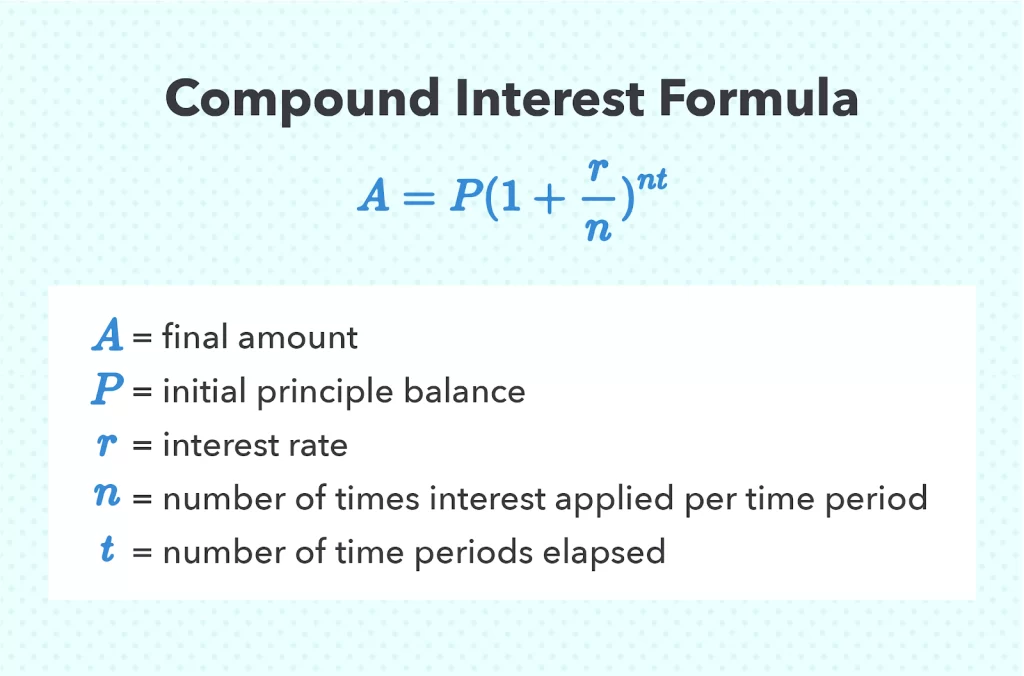

What Is Compound Interest?

Compound interest is a powerful concept in the world of finance that can significantly boost your savings and investments over time.

Unlike simple interest, which is calculated only on the initial amount (principal) you deposit or invest, compound interest takes into account both the principal and any interest that has already been earned or accrued. In simple terms, it’s interest on interest.

When you earn interest on your initial investment, and then that interest itself earns more interest, your savings or investments can grow at an accelerated rate. This compounding effect can turn even modest contributions into substantial wealth over the long term.

Imagine you have a savings account, an investment, or a retirement fund. With compound interest, not only do you earn interest on your initial deposit, but as time goes on, your earnings generate additional earnings.

This creates a snowball effect, helping you reach your financial goals faster and more efficiently.

Here are 3 key reasons why compound interest matters:

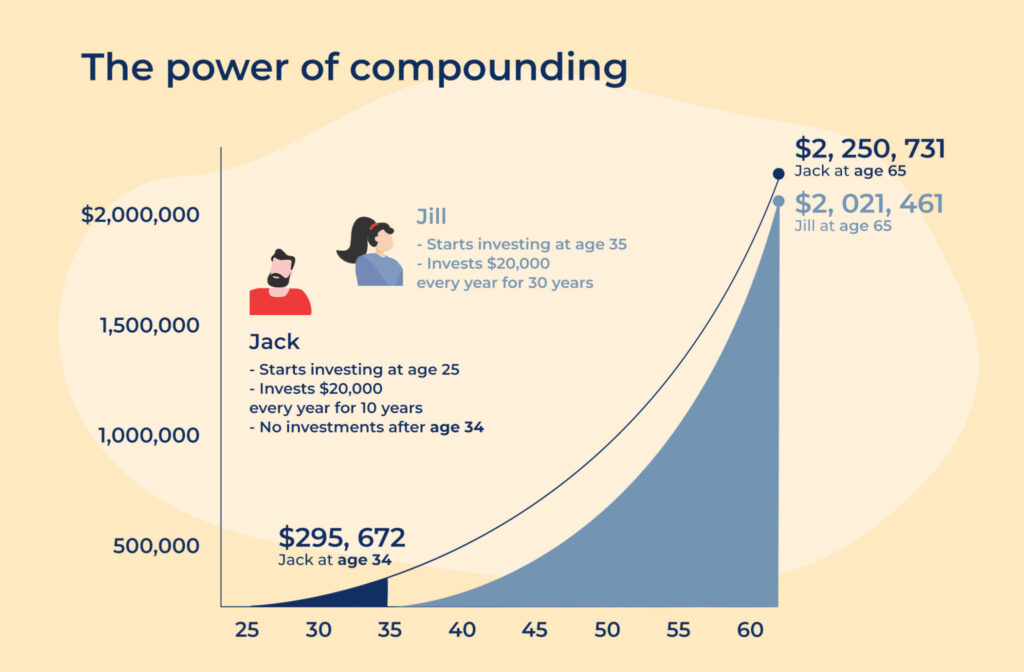

- Exponential Growth: As time goes on, this compounding effect multiplies your earnings, leading to substantial wealth over the long term. This means that the longer your money is invested or saved, the more significant the impact of compound interest.

- Efficiency in Wealth Building: Compound interest is a highly efficient way to build wealth. It enables your money to work for you, continually generating earnings from your existing earnings. (Even with relatively small contributions or investments, compound interest can turn these modest sums into substantial assets over time.)

- Time Is Your Ally: The longer your money remains invested, the more significant the financial benefits become. Starting early and allowing your investments to compound over decades can lead to substantial wealth accumulation. (This means that the earlier you begin saving or investing, the more you can leverage time to your advantage and secure your financial future.)

How Compound Interest Differs from Simple Interest ?

The key difference between compound interest and simple interest is in how they calculate the interest earned:

- Simple Interest: With simple interest, you earn interest solely on the initial principal amount. The interest remains constant, calculated as a percentage of the principal. It doesn’t take into account any interest you’ve previously earned.

- Compound Interest: With compound interest, interest is calculated on both the initial principal and any accumulated interest. As time progresses, the interest is recalculated on the new total, resulting in exponential growth.

To put it simply, compound interest rewards you for not only saving or investing your money but also for leaving it there to grow over time. So, the longer your money remains invested, the more powerful the impact of compound interest becomes.

Real-Life Examples

Here you find 3 real-life scenarios that illustrate how to apply compound interest calculations using a calculator in different financial situations:

Scenario 1: Saving for Retirement

Imagine you’re planning for retirement and want to see how your savings will grow over time. Let’s say you have an initial retirement fund of $50,000, and you plan to retire in 30 years. You’re aiming for an annual interest rate of 6%. Using the compound interest calculator:

- Principal Amount (P): $50,000

- Annual Interest Rate (r): 6%

- Time in Years (t): 30

When you plug these values into the calculator, you’ll find that your retirement fund will grow to approximately $239,695.16. This calculation helps you understand how your savings can compound over the years and guides you in setting a realistic retirement savings goal.

Scenario 2: Investing for a Child’s Education

Suppose you’re saving for your child’s college education. You’ve already accumulated $10,000 in an education fund, and you have 15 years until your child goes to college. You expect an annual interest rate of 7%. Using the calculator:

- Principal Amount (P): $10,000

- Annual Interest Rate (r): 7%

- Time in Years (t): 15

The calculator will show that your education fund will grow to approximately $27,067.88. This calculation helps you estimate how much money you’ll have available for your child’s education, allowing you to plan and adjust your contributions accordingly.

Scenario 3: Investing in Stocks

You’re considering investing in the stock market and want to see how your investments can grow over time. Let’s say you have $5,000 to invest now and plan to add $200 each month. You’re aiming for an annual interest rate of 8%, and you plan to invest for 20 years. Using the calculator:

- Principal Amount (P): $5,000

- Monthly Contribution: $200

- Annual Interest Rate (r): 8%

- Time in Years (t): 20

By entering these values, the calculator will show that your investment will grow to approximately $111,331.33. This calculation helps you visualize the potential growth of your stock investments and assists in your decision-making and long-term financial planning.

These scenarios demonstrate how a compound interest calculator can be applied to various financial situations.

By inputting the principal amount, interest rate, and time frame, you can estimate how your money will grow over time and make informed financial decisions.

Final Thoughts

Here are some valuable resources where you can learn more about compound interest and personal finance:

Other Useful Calculators:

- The Best Free Savings Calculator of 2023

- Best Return on Investment Calculator (ROI) Free to Use

- Profit Loss Calculator: Best Free to Use

- The Best Crypto Mining Profitability Calculator of 2023

Useful Website:

- Investopedia.com (is a trusted source for comprehensive financial information.)

Useful Books:

( #Amazon adv )

- “The Simple Path to Wealth: Your road map to financial independence and a rich, free life” by J.L. Collins

- “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” by Helaine Olen and Harold Pollack

- “Smart Women Finish Rich” by David Bach

Recent Posts

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Understand Crypto with the Best Books that You Need NowLet’s dive in and understand the crypto world with the books that you need to read now, that promise to enrich your understanding and guide you toward crypto success. In a world where the crypto landscape evolves at lightning speed,…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- The Best Way to Store Your Crypto InvestmentsIn this digital age, the best way to store your cryptos, are in these 4 safe and secure crypto wallets that, are not just tools; they are your guardians of wealth in the virtual frontier. As you navigate the complexities…

- The Best Way to Mine Crypto with ComputersWhether you’re driven by the allure of Bitcoin, Ethereum, or the multitude of altcoins, your journey starts here. “The Best and Powerful Crypto Mining Computers” is your gateway to an exciting world of digital wealth Whether you are a seasoned…

Frequently Asked Questions (FAQs)

What Do the Calculator Results Mean?

The calculator will provide you with the total amount you’ll have at the end of the specified time frame. It’s the amount you can expect to have if you maintain your investment or savings plan based on the given parameters.

Can I Use the Calculator for Various Financial Goals?

Absolutely! ‘The Best’ Free Compound Interest Calculator is versatile and can be used for a wide range of financial goals. Whether you’re saving for retirement, an emergency fund, or a specific purchase, the calculator can help you estimate your future wealth.

Why Is Compound Interest Important?

Compound interest is crucial because it can significantly boost your savings or investments, turning modest contributions into substantial wealth over the long term. It is a powerful tool for achieving financial goals and securing your future.

How Does Time Affect Compound Interest?

Time plays a significant role in compound interest. The longer your money is invested or saved, the more significant the impact of compounding. Even small changes in the time frame can lead to substantial differences in the final amount.

Is Compound Interest Always Positive?

Compound interest can be both positive (when you’re earning interest on your savings or investments) and negative (when you’re paying interest on loans). In the context of savings and investments, it’s typically positive.

Is Compound Interest the Same as Annual Percentage Yield (APY)?

No, compound interest and APY are related but not the same. APY is a more comprehensive measure that includes compounding and reflects the effective annual rate of return, including fees and compounding frequency.

What’s the Difference Between the Future Value and the Compound Interest Amount?

The “future value” is the total amount you will have, including both the principal and the interest earned. The “compound interest amount” is the interest earned on top of the principal. The future value is the sum of the principal and the compound interest amount.

What Is the Rule of 72, and How Does It Relate to Compound Interest?

The Rule of 72 is a simple formula used to estimate how long it will take to double your money at a fixed annual rate of return. It is closely related to compound interest and provides a quick way to assess the potential growth of your investments.