ETFs vs Stocks : What is Better to Succeed

ETFs vs Stocks ?

In the world of investment, this is a common question and an age-old debate, but it is an important choice to make, because it can make or break your route to financial success. Let’s dive into this ETFs vs Stocks face-off and discover which one holds the key to your financial future.

I truly hope that after reading this post, whenever someone will start with you a debate between Etfs vs Stocks you will surely know how to respond, without doubts and with confidence.

(This website may contain affiliate links, which means that if you click on a product or service link and make a purchase, I may earn a commission. This commission comes at no additional cost to you. I only recommend products or services that I believe are valuable and can benefit my readers. Your support through these affiliate links helps me maintain and improve this website. Thank you for your support.)

ETFs vs Stocks Comparison

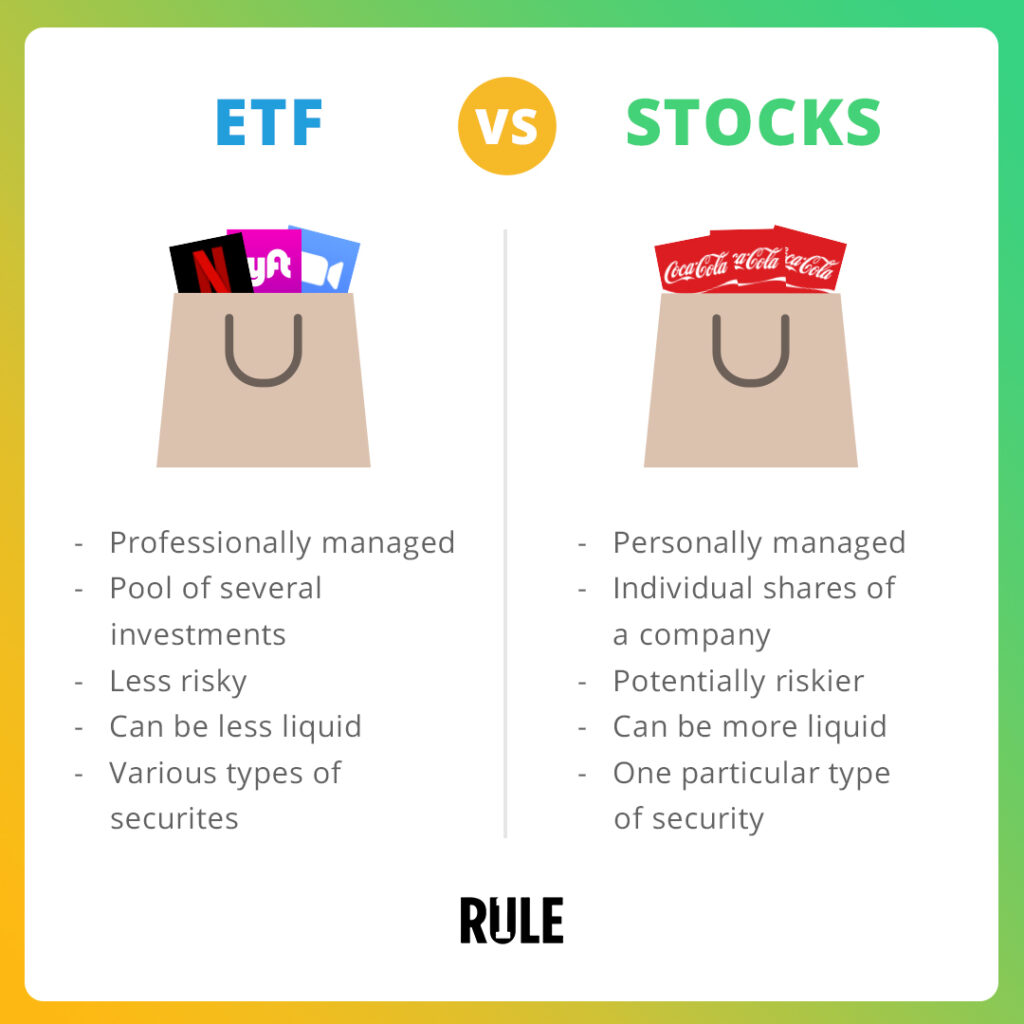

When we compare ETFs (Exchange-Traded Funds) vs stocks, there are crucial distinctions to take in consideration :

- Ownership and Structure:

- Stocks represent ownership in a specific company, providing shareholders (partial company owners) with a stake in the company’s profits and losses.

- ETFs are investment funds that hold a diversified portfolio of assets, which can include stocks, bonds, commodities, or other securities (like REITs). ETF investors, instead own a share of the entire fund, not individual assets.

- Diversification:

- Stocks offer limited diversification, because you’re investing in a single company. The performance is related to that company’s fortunes.

- ETFs, alternatively provide instant diversification by holding a basket of assets. This spreads risk across multiple securities and reduces the impact of a single asset’s poor performance.

- Liquidity:

- Stocks of large, well-established companies (like Amazon, Apple or Walmart) are generally highly liquid, meaning they can be easily bought or sold in the stock market.

- ETFs like stocks are also highly liquid as they trade on stock exchanges throughout the trading day, offering flexibility in buying and selling. (Some examples of ETfs that were historically known for their liquidity are : SPDR S&P 500 ETF Trust (SPY) , Invesco QQQ Trust (QQQ), SPDR Gold Trust (GLD) , or the (EEM) iShares MSCI Emerging Markets ETF)

- Management and Costs:

- Stocks require individual management and research to make informed investment decisions.

- ETFs are passively managed in most cases, tracking an underlying index, which typically results in lower management fees compared to actively managed funds or stocks.

- Trading Flexibility:

- Stocks can be bought and sold at market prices during trading hours. We as investors, we can use various order types, such as limit or stop orders, to control our trades.

- ETFs, similar to stocks, can be traded during the day at market prices. They also offer trading flexibility but often with lower bid-ask spreads.

- Dividends:

- Stocks may pay dividends, providing a portion of the company’s earnings to shareholders. Remember that not all companies offer dividens.

- Some ETFs pay dividends based on the income generated from their underlying assets. (An example can be the iShares Select Dividend ETF (DVY), that tracks the performance of the Dow Jones U.S. Select Dividend Index, which includes high dividend yield U.S. stocks)

- Risk and Volatility:

- Individual stocks can be more volatile.

- ETFs tend to be less volatile due to diversification, but their performance can still be affected by market conditions and the assets they hold.

- Customization:

- Stocks allow investors to build a customized portfolio based on their preferences and risk tolerance.

- ETFs offer pre-built diversification and thematic options, making it easy to invest in specific sectors, regions, or investment strategies.

- Tax Efficiency:

- ETFs are often more tax-efficient due to their structure, compared to actively managed mutual funds.

- Stocks may generate capital gains taxes when sold, potentially impacting overall returns

When choosing between ETFs and Stocks we need to understand these key differences in order to make informed decisions

(The information provided on this website is for educational and informational purposes only and should not be considered as financial advice.)

Pros and Cons of ETFs

Advantages of Investing in ETFs :

- ETFs offer instant diversification

- ETFs are traded on stock exchanges during the trading day

- Many ETFs are passively managed and often results in lower management fees.

- ETFs typically reveal their holdings daily, allowing investors to know precisely what assets are held within the fund.

- ETFs can be bought and sold easily.

- ETFs are often more tax-efficient .

- ETFs cover a wide range of asset classes, sectors, and investment strategies.

Potential Negatives of Investing in ETFs:

- When investing in an ETF, you have limited control over the specific assets within the fund

- ETFs aim to replicate the performance of an underlying index, but they may not perfectly match the index’s returns due to tracking errors.

- In less liquid ETFs, spreads may be wider, potentially impacting trading costs.

- The market price of an ETF’s shares can sometimes deviate from the net asset value (NAV) of the underlying assets

- Some ETFs use derivatives and complex strategies, making them less suitable for inexperienced investors.

- While many ETFs pay dividends based on the income generated from their holdings, the frequency and amount of dividends can vary. Investors looking for predictable income may prefer other investments.

- The facility of trading ETFs can lead some investors to engage in excessive trading.

ETFs offer numerous advantages, however, they may not be appropriate for all investors, particularly those seeking more control over their investments.

Pros and Cons of Stocks

Benefits of Investing in Individual Stocks:

- Individual stocks offer the potential for substantial capital appreciation.

- When you invest in individual stocks, you have direct control over your portfolio.

- Some companies pay dividends to their shareholders.

- Owning individual stocks means you have ownership in a specific company.

- Investors in individual stocks can access detailed financial information and reports.

- Holding individual stocks allows for tax planning strategies such as tax-loss harvesting or optimizing capital gains.

Poossible Disadvantages of Investing in Individual Stocks:

- Investing in individual stocks carries company-specific risk.

- Owning individual stocks can result in limited diversification.

- Successfully investing in individual stocks requires research and analysis.

- Individual stocks can be highly volatile.

- Managing a portfolio of individual stocks can be time-consuming.

- Not all stocks pay dividends.

- Individual stock investing can be emotionally challenging.

- Buying and selling individual stocks may involve transaction costs, including brokerage commissions, which can erode returns, particularly for frequent traders.

So, in simple terms we can say that individual stocks offer the potential for significant returns and provide control over investment choices. However, they come with higher risks, and investing in equities require more research and monitoring.

Remember that balancing individual stocks with ETFs can help mitigate risks and align you with your specific investment goals and preferences.

(The information provided on this website is for educational and informational purposes only and should not be considered as financial advice.)

Final Thoughts

Remember, when it comes to investing and comparing ETFs vs Stocks, knowledge is power. And for this reason i would like to suggest you some good books that can help you gain lots of insights and expertise.

(This website may contain affiliate links, which means that if you click on a product or service link and make a purchase, I may earn a commission. This commission comes at no additional cost to you. I only recommend products or services that I believe are valuable and can benefit my readers. Your support through these affiliate links helps me maintain and improve this website. Thank you for your support.)

Here you fill find my top 5 books in order to declare yourself the winner of the ETFs vs Stocks battle :

- “The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

- “A Random Walk Down Wall Street” by Burton G. Malkiel

- “The ETF Book: All You Need to Know About Exchange-Traded Funds” by Richard A. Ferri

- “Stocks for the Long Run” by Jeremy J. Siegel

- “The Four Pillars of Investing” by William J. Bernstein

- “Investing in ETFs for Dummies” by Russell Wild

- “The Investor’s Manifesto” by William J. Bernstein

If you want to see more related books check this post :

Recent Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- IPO Explained : How to Start the Right WayIPO explained simply. Ever thought about how companies go from being private to being in the stock market spotlight? It’s through something called an Initial Public Offering, or IPO. It’s like a big debut for companies, with lots of potential…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Penny Stocks vs Crypto : What is the Best Solution ?In this exploration of Penny Stocks vs. Crypto, we will delve into the heart of these investment choices. Penny Stocks and Cryptocurrencies, each of these asset classes carries its own unique set of promises and perils, offering the potential for…