The Best French Dividend Stocks of 2023

We will delve into the factors that make French dividend stocks a compelling choice. We turn our focus to France, seeking out the crème de la crème of income-generating equities.

What Are Dividend Stocks?

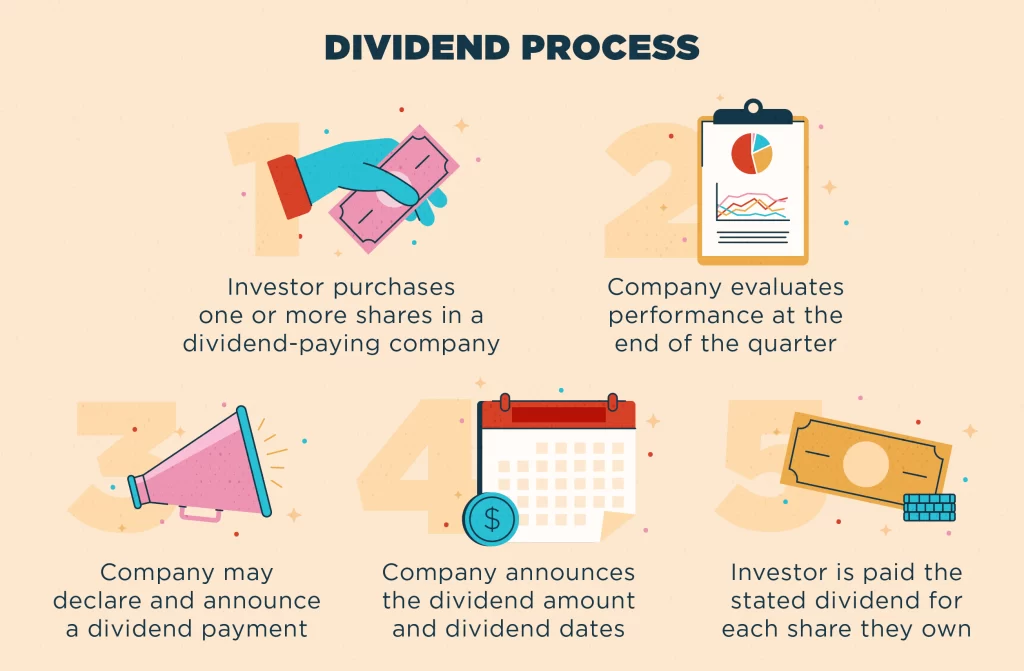

Dividend stocks are a type of investment in which shareholders receive a portion of a company’s profits on a regular basis, usually in the form of cash payments or additional shares of stock.

These payments are known as dividends, and they are typically distributed quarterly, although some companies pay them annually or on other schedules.

Why Are Dividend Stocks so Popular ?

Dividend stocks have gained popularity among investors for several reasons:

- Steady Income Stream: Investors, especially those who rely on their investments to cover living expenses, appreciate the regular cash flow that dividends offer.

- Potential for Capital Appreciation: Dividend stocks can also provide the opportunity for capital appreciation.

- Historical Consistency: Many dividend-paying companies have a long history of consistent dividend payments. This reliability appeals to risk-averse investors.

- Dividend Reinvestment: Investors have the option to reinvest their dividends into additional shares of the same stock, a practice known as “dividend reinvestment”. This allows for compounding returns over time.

- Inflation Hedge: As the cost of living rises, dividend income from well-established companies may also increase, helping investors maintain purchasing power.

- Less Volatility: Dividend stocks tend to exhibit lower price volatility compared to non-dividend-paying stocks.

- Signal of Financial Health: Companies that consistently pay dividends are often seen as financially stable and well-managed.

- Diversification: Dividend stocks can be found in various sectors, allowing us to diversify our portfolios while still enjoying the benefits of regular income.

Best French Dividend Stocks for 2023

Here’s the list of the best french dividend stocks:

- Sanofi (Ticker: SNY)

- Sector: Healthcare

- Products: Pharmaceuticals and Vaccines

- Dividend Yield (as of 2021): Approximately 3.5%

- P/E Ratio (as of 2021): Around 13.5

- Sanofi is a global pharmaceutical company known for its wide range of healthcare products and medicines.

- TotalEnergies SE (Ticker: TTE)

- Sector: Energy

- Products: Oil, Natural Gas, and Renewables

- Dividend Yield (as of 2021): Approximately 5.6%

- P/E Ratio (as of 2021): Approximately 11.9

- TotalEnergies is a major energy company engaged in various energy-related activities, including oil and gas exploration and renewable energy projects.

- L’Oréal (Ticker: OR)

- Sector: Consumer Goods

- Products: Cosmetics and Beauty Products

- Dividend Yield (as of 2021): Around 1.6%

- P/E Ratio (as of 2021): Approximately 38.2

- L’Oréal is a world-renowned cosmetics and beauty company with a vast portfolio of brands.

- Bouygues SA (Ticker: EN)

- Sector: Construction and Telecom

- Products: Construction, Real Estate, and Telecom Services

- Dividend Yield (as of 2021): Approximately 4.1%

- P/E Ratio (as of 2021): Approximately 11.7

- Bouygues is a diversified company involved in construction, real estate development, and telecommunications.

- Air Liquide SA (Ticker: AI)

- Sector: Industrials

- Products: Industrial Gases and Services

- Dividend Yield (as of 2021): Approximately 2.2%

- P/E Ratio (as of 2021): Around 28.6

- Air Liquide is a global supplier of industrial gases and related services.

- Danone SA (Ticker: BN)

- Sector: Consumer Goods

- Products: Dairy and Health Food Products

- Dividend Yield (as of 2021): Approximately 3.4%

- P/E Ratio (as of 2021): Approximately 17.3

- Danone is a multinational food company specializing in dairy products, water, and health-oriented foods.

- Société Générale SA (Ticker: GLE)

- Sector: Financials

- Products: Banking and Financial Services

- Dividend Yield (as of 2021): Approximately 2.3%

- P/E Ratio (as of 2021): Approximately 5.9

- Société Générale is a leading French bank offering various financial services.

- Veolia Environnement SA (Ticker: VIE)

- Sector: Utilities and Environmental Services

- Products: Water, Waste Management, and Energy Services

- Dividend Yield (as of 2021): Approximately 2.8%

- P/E Ratio (as of 2021): Approximately 20.4

- Veolia is a global environmental services company specializing in water, waste, and energy management.

- VINCI SA (Ticker: DG)

- Sector: Construction and Infrastructure

- Products: Construction, Infrastructure Development, and Concession Operations

- Dividend Yield (as of 2021): Approximately 2.7%

- P/E Ratio (as of 2021): Approximately 13.1

- VINCI is a leading construction and infrastructure company with global operations.

- Engie SA (Ticker: ENGI)

- Sector: Utilities and Energy

- Products: Electricity, Natural Gas, and Renewable Energy

- Dividend Yield (as of 2021): Approximately 6.1%

- P/E Ratio (as of 2021): Approximately 9.8

- Engie is a multinational utility company involved in electricity, gas, and renewable energy production and distribution.

- Pernod Ricard SA (Ticker: RI)

- Sector: Consumer Goods

- Products: Alcoholic Beverages

- Dividend Yield (as of 2021): Approximately 1.6%

- P/E Ratio (as of 2021): Approximately 30.8

- Pernod Ricard is a leading producer of alcoholic beverages, including brands like Absolut, Jameson, and Chivas Regal.

- Capgemini SE (Ticker: CAP)

- Sector: Information Technology

- Products: IT Services and Consulting

- Dividend Yield (as of 2021): Approximately 1.2%

- P/E Ratio (as of 2021): Approximately 24.6

- Capgemini is a global IT services and consulting firm.

- Schneider Electric SE (Ticker: SU)

- Sector: Industrials

- Products: Energy Management and Automation Solutions

- Dividend Yield (as of 2021): Approximately 2.0%

- P/E Ratio (as of 2021): Approximately 26.4

- Schneider Electric is a multinational corporation specializing in energy management and automation.

- Publicis Groupe SA (Ticker: PUB)

- Sector: Communication and Advertising

- Products: Advertising and Marketing Services

- Dividend Yield (as of 2021): Approximately 3.2%

- P/E Ratio (as of 2021): Approximately 10.4

- Publicis Groupe is a global advertising and communications company.

- Kering SA (Ticker: KER)

- Sector: Consumer Goods

- Products: Luxury Fashion and Accessories

- Dividend Yield (as of 2021): Approximately 1.3%

- P/E Ratio (as of 2021): Approximately 33.1

- Kering is a luxury fashion conglomerate with brands such as Gucci, Saint Laurent, and Balenciaga.

If you want to dive more on these companies, you can check a very useful financial website: www.morningstar.com (Morningstar is a well-known financial services company that provides investment research, data, and analysis for investors)

Final Toughts

I hope you enjoyed the reading, and if you’d like to continue feeding your knowledge, here’s a useful post for you:

Recent Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- IPO Explained : How to Start the Right WayIPO explained simply. Ever thought about how companies go from being private to being in the stock market spotlight? It’s through something called an Initial Public Offering, or IPO. It’s like a big debut for companies, with lots of potential…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Penny Stocks vs Crypto : What is the Best Solution ?In this exploration of Penny Stocks vs. Crypto, we will delve into the heart of these investment choices. Penny Stocks and Cryptocurrencies, each of these asset classes carries its own unique set of promises and perils, offering the potential for…