The Best Free Inflation Calculator to Use

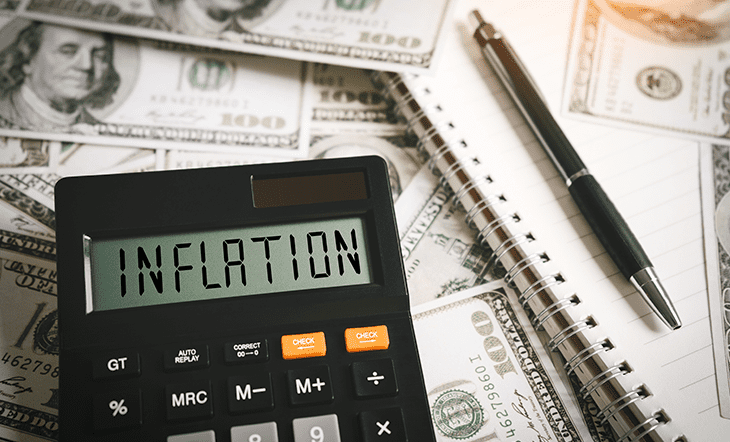

Understanding inflation is key because it impacts your everyday life and future plans. That’s where our free inflation calculator comes in – it helps you see and plan for its effects.

Inflation Calculator with Chart

Inflation, the silent force that erodes the purchasing power of your hard-earned money, can have a significant effect on your financial stability and long-term goals.

As prices of goods and services rise over time, the money you save today could be worth less in the future.

How to Use the Free Inflation Calculator ?

You’ll need to enter three crucial pieces of information:

- Current Amount: Begin by inputting the amount of money you currently have or plan to save or invest. (This could be your current savings, an investment amount, or any other financial figure you wish to analyze.)

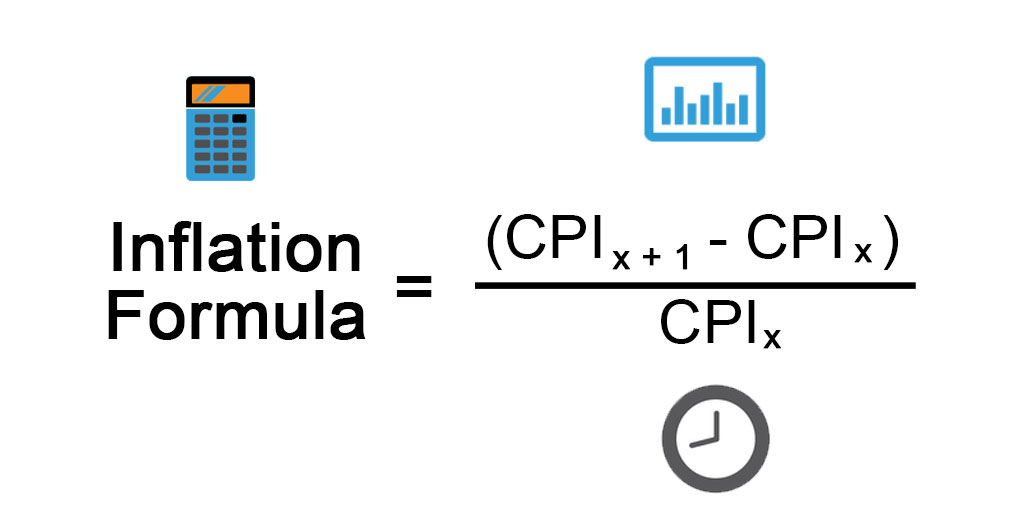

- Annual Inflation Rate: Specify the annual inflation rate. (This rate represents the anticipated increase in prices over time. You can find this information from reliable financial sources or use historical averages.)

- Number of Years: Determine the number of years over which you want to project the impact of inflation. (This could range from a few years for short-term goals to several decades for long-term financial planning.)

Accuracy and Reliability:

The free inflation calculator is built on a robust and tested mathematical model. It ensures accuracy and reliability in providing projections of how inflation will affect your money. While no tool can predict future inflation rates with absolute certainty, this calculator offers a solid foundation for making informed financial decisions.

What Is Inflation ?

Inflation is like a slow rise in the prices of things you buy over time. Imagine if your $100 today could only buy what $80 used to buy. It’s a bit like your money losing its superpower.

Here’s 5 reasons on why it’s important to understand what inflation is :

1. Shrinking Buying Power: Inflation makes your money buy less, so you need more dollars for the same things.

2. Saving Dilemma: If your savings don’t grow as fast as prices rise, you could end up with less money than you thought.

3. Future Planning: It can make planning for future goals, like a home or retirement, trickier since you’ll need more money in the future.

4. Fixed Incomes: People on fixed incomes (like retirees) feel it most because their money doesn’t stretch as far.

5. Economic Rollercoaster: When inflation jumps around a lot, it can make everything uncertain, from job security to daily expenses.

Benefits of Using a Free Inflation Calculator

An inflation calculator is not just a handy tool; it’s an essential asset for individuals working towards financial autonomy

Here are the key benefits it offers:

1. Informed Financial Decisions:

- An inflation calculator provides a clear picture of how prices will likely rise in the future. With this knowledge, you can make more accurate financial decisions.

- Smart Purchases: It helps you evaluate whether a major purchase, like a house or car, is financially viable over the long term by considering future price increases.

- Investment Insights: For investors, like you and me, it’s a valuable tool to assess the impact of inflation on investment returns.

2. Future Planning:

- Parents can plan for their children’s education expenses with confidence, knowing the calculator considers inflation’s effect on tuition and related costs.

3. Setting Realistic Goals:

- Inflation calculators ground your financial aspirations in economic reality. This enables you to set achievable goals.

- Motivation: Realistic goals are more motivating because you can track your progress with confidence, knowing that you’re on the right path.

- Reduced Stress: By understanding how inflation affects your financial future, you can reduce financial stress and uncertainty, fostering peace of mind.

Whether it’s saving for a dream vacation, starting a business, or any significant goal, our free inflation calculator helps you create a realistic savings plan.

Real-Life Examples of Using the Inflation Calculator

The inflation calculator is a versatile tool that can be applied to various real-life scenarios.

Here are a few examples to illustrate how users can utilize the calculator for different financial goals:

1. Retirement Planning:

- Scenario: Suppose you’re planning for your retirement, and you have $500,000 in savings. You want to understand how inflation may impact your retirement fund over 25 years.

- What you do? : Input your current savings ($500,000), an estimated annual inflation rate (e.g., 3%), and the number of years until retirement (25) into the inflation calculator.

- Result: The calculator will project the future value of your $500,000, factoring in an annual 3% inflation rate over 25 years. It will show you the adjusted amount you’ll need in the future to maintain the same purchasing power.

2. Saving for a Major Purchase:

- Scenario: Let’s say you’re planning to buy a home in 10 years, and you’ve saved $50,000 for the down payment. You want to know if this amount will be sufficient given expected inflation.

- What you do ? : Input your current savings ($50,000), an estimated annual inflation rate (e.g., 2.5%), and the number of years until the purchase (10) into the calculator.

- Result: The calculator will provide the future value of your $50,000 considering a 2.5% annual inflation rate over 10 years. This helps you assess whether your savings are on track for your home purchase.

3. College Tuition Planning:

- Scenario: You’re saving for your child’s college education, and the current cost of tuition is $20,000 per year. You want to know how much you’ll need in the future when your child is ready for college in 15 years.

- What you do ? : Input the current tuition cost ($20,000), the estimated annual inflation rate for education expenses (e.g., 5%), and the number of years until college (15) into the calculator.

- Result: The calculator will project the future tuition cost based on a 5% annual inflation rate over 15 years. This helps you determine how much you should save to cover the anticipated expenses.

4. Investment Evaluation:

- Scenario: You’re considering an investment with an expected return of 7% per year, but you want to assess the real return after accounting for inflation.

- What you do ? : Input your investment amount, the expected return (7%), and the estimated annual inflation rate (e.g., 2%) into the calculator.

- Result: The calculator will help you determine the real return on your investment after adjusting for inflation, allowing you to make informed decisions about potential investments.

5. Salary Negotiation:

- Scenario: You’re about to negotiate a new job offer, and you want to understand how your salary may be affected by inflation over the next five years.

- What you do ? : Input your starting salary, the expected annual salary increase (e.g., 4%), and the number of years you’ll be in the job (5) into the calculator.

- Result: The calculator will project your future salary considering annual increases and the impact of inflation. This helps you negotiate a fair compensation package.

6. Long-Term Debt Analysis:

- Scenario: You have a 30-year mortgage, and you want to see how the value of your monthly mortgage payments may change over time due to inflation.

- What you do ? : Input your initial monthly mortgage payment, the estimated annual inflation rate (e.g., 2.5%), and the number of years (e.g., 30) into the calculator.

- Result: The calculator will show you how the real value of your mortgage payments will decrease over the 30-year term due to inflation, helping you plan for your budget accordingly.

7. Cost of Living Adjustment:

- Scenario: You’re receiving a fixed monthly pension, and you want to estimate the impact of inflation on your purchasing power over the next 15 years.

- What you do ? : Input your current monthly pension, the expected annual inflation rate (e.g., 3%), and the number of years (15) into the calculator.

- Result: The calculator will project the future value of your pension income, allowing you to understand how it will be affected by rising living costs.

These examples demonstrate the versatility of our inflation calculator in various financial contexts.

FAQs

In rare cases, inflation can be accompanied by stagnant economic growth and high unemployment, a situation known as stagflation.

Central banks use monetary policy, particularly interest rates, to control inflation. They may raise rates to cool an overheating economy or lower rates to stimulate growth.

Hyperinflation can lead to severe economic and social consequences, including the devaluation of currency, loss of savings, and economic instability.

Low and stable inflation rates can provide a predictable economic environment, making it easier for businesses and individuals to plan for the future.

The Federal Reserve, the central bank of the United States, uses monetary policy tools, particularly interest rates, to manage inflation and promote economic stability.

While economists use various indicators to predict inflation, it’s challenging to predict with absolute certainty, as many factors can influence it.

In some cases, individuals with certain assets like real estate stocks or cryptos may benefit from inflation, as the value of these assets can increase.

Final Thoughts

But as with any topic in personal finance, the learning never truly ends. To delve even deeper into the phenomenon of inflation, here are some recommended books to consider:

(As an Amazon Associate, Your support through these affiliate links is greatly appreciated.)

- “This Time Is Different: Eight Centuries of Financial Folly” by Carmen M. Reinhart and Kenneth S. Rogoff

- “The Federal Reserve and the Financial Crisis” by Ben S. Bernanke

- “When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany” by Adam Fergusson

- “Irrational Exuberance” by Robert J. Shiller

- “The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else” by Hernando de Soto

Now, if you’re hungry for more financial calculators to aid in your journey towards financial empowerment, here are some valuable resources to explore:

- The Best Free Savings Calculator of 2023

- Profit Loss Calculator: Best Free to Use

- The Best Crypto Mining Profitability Calculator of 2023

- The Best Free Compound Interest Calculator (CIC)

Recent Posts

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Understand Crypto with the Best Books that You Need NowLet’s dive in and understand the crypto world with the books that you need to read now, that promise to enrich your understanding and guide you toward crypto success. In a world where the crypto landscape evolves at lightning speed,…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- The Best Way to Store Your Crypto InvestmentsIn this digital age, the best way to store your cryptos, are in these 4 safe and secure crypto wallets that, are not just tools; they are your guardians of wealth in the virtual frontier. As you navigate the complexities…

- The Best Way to Mine Crypto with ComputersWhether you’re driven by the allure of Bitcoin, Ethereum, or the multitude of altcoins, your journey starts here. “The Best and Powerful Crypto Mining Computers” is your gateway to an exciting world of digital wealth Whether you are a seasoned…