The Best Value Investing Strategy : From Beginner to Pro

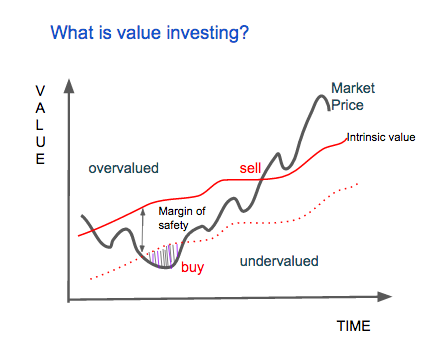

Value investing is an investment strategy rooted in the concept of identifying and acquiring assets, typically stocks, that are undervalued by the market.

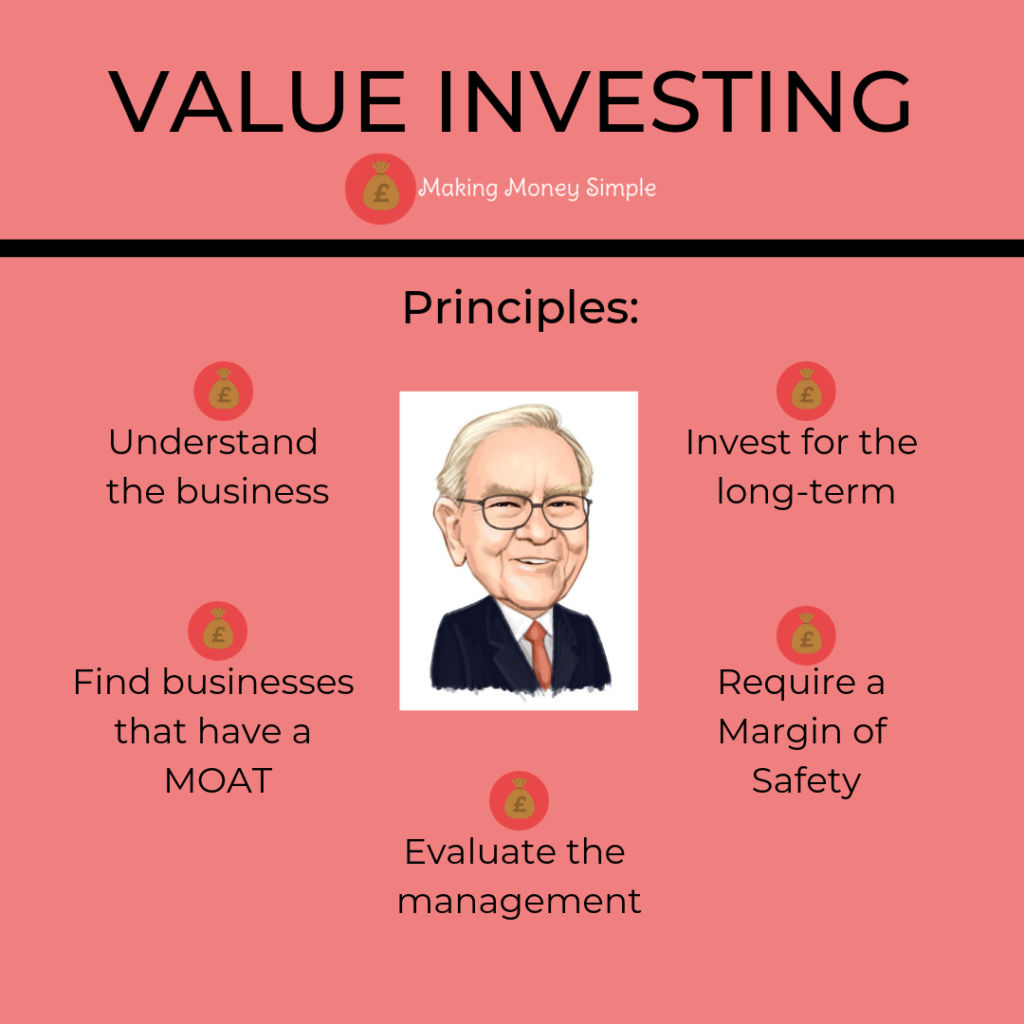

The core principles of value investing are based on a few fundamental ideas:

- Intrinsic Value: Value investors believe that every asset has an intrinsic or true value.

- Margin of Safety: Investors should buy assets at a price significantly below their intrinsic value, creating a margin of safety.

- Long-Term Perspective: Value investing is inherently long-term. Investors who follow this philosophy focus on holding their assets for extended periods.

- Fundamental Analysis: Value investors extensively analyze the financial health and performance of the companies they invest in.

Why Value Investing is Essential for Long-Term Wealth Accumulation ?

Value investing is crucial for long-term wealth accumulation due to 4 reasons:

- Risk Mitigation: By buying undervalued assets with a margin of safety, value investors reduce the risk of substantial losses.

- Consistency: Value investing focuses on the fundamentals of companies, which tend to change less rapidly than stock prices.

- Compound Returns: Over time, you can benefit from the power of compound returns.

- Behavioral Discipline: Value investing discourages impulsive decisions and emotional reactions to market volatility.

Real-World Example – Warren Buffett:

One of the most celebrated value investors is Warren Buffett, often referred to as the “Oracle of Omaha.” His investment company, Berkshire Hathaway, is a prime example of the success of value investing principles.

Buffett’s wealth was predominantly built by adhering to these principles:

- Buffett famously invested in undervalued companies like Coca-Cola and American Express, holding these positions for decades.

- He consistently emphasizes the importance of long-term investment, often saying his preferred holding period for stocks is “forever.”

- Through his patient and disciplined approach, Buffett has amassed one of the largest fortunes in the world, demonstrating the effectiveness of value investing for long-term wealth accumulation.

More examples

Here are a few more real-world examples of successful value investors who have accumulated wealth through their adherence to value investing principles:

- Benjamin Graham: Often considered the father of value investing.

- Charlie Munger: Charlie Munger is Warren Buffett’s long-time business partner and Vice Chairman of Berkshire Hathaway.

- Seth Klarman: Seth Klarman, the founder of Baupost Group, is known for his value investing acumen. His investment firm has delivered consistently strong returns by following the principles of value investing.

- Joel Greenblatt: Joel Greenblatt is a successful hedge fund manager.

- Irving Kahn: Irving Kahn was one of the oldest and most respected value investors before his passing in 2015 at the age of 109. He was a student of Benjamin Graham and had a remarkable track record of value investing over the decades.

- Mohnish Pabrai: Mohnish Pabrai is a contemporary value investor. He’s known for adopting the principles of Warren Buffett and Charlie Munger in his investment approach.

They have consistently demonstrated the power of buying undervalued assets and holding them patiently.

Analyzing Stocks for Value

Value investing is a methodical approach to investing in stocks with the goal of finding undervalued assets.

Here’s a detailed explanation, including key financial metrics, step-by-step guidance on how to research and select stocks, and recommendations for online tools or software to asssist you during the analysis.

How to Value Invest ?

Value investing is a systematic process that involves assessing a company’s financial health, performance, and market position to identify undervalued stocks. To achieve this, follow these 8 steps:

Step 1: Define Your Investment Criteria

- Begin by establishing your investment objectives, risk tolerance, and investment horizon.

- Determine which industries or sectors you are interested in.

Step 2: Tools for a value investing strategy

- Utilize stock screening tools or software, such as Finviz, to filter stocks based on predetermined criteria like market capitalization, price-to-earnings (P/E) ratio, and price-to-book (P/B) ratio.

Step 3: Evaluate Financial Metrics

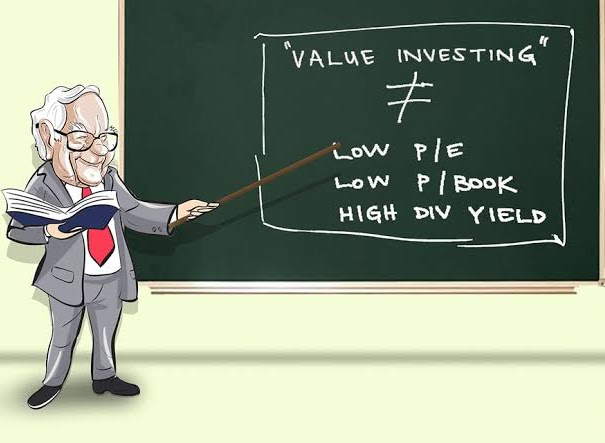

- P/E Ratio: This metric compares the stock’s current price to its earnings per share (EPS). A lower P/E ratio may suggest that the stock is undervalued in comparison to its earnings potential.

- P/B Ratio: The price-to-book ratio assesses the stock’s market price relative to its book value (total assets minus total liabilities). A lower P/B ratio implies that the stock may be undervalued.

- Debt Levels: Review the company’s debt-to-equity ratio to gauge its leverage. A lower ratio indicates a healthier balance sheet.

- Dividend Yield: Consider the dividend yield, which represents annual dividend payments as a percentage of the stock’s price. Higher yields may attract income-focused investors.

In addition to the key financial metrics mentioned earlier (P/E ratio, P/B ratio, debt-to-equity ratio, and dividend yield), there are several other financial metrics and indicators that are commonly used among the value investors.

When considering whether a stock is a good value investment, or not, it’s important that you look, also, at these additional metrics as well:

- Earnings Growth: You should check for consistent and sustainable growth in earnings over time.

- Price-to-Sales (P/S) Ratio: A lower P/S ratio suggests that the stock may be undervalued relative to its revenue generation.

- Price-to-Free Cash Flow (P/FCF) Ratio: The P/FCF ratio measures the stock’s market price relative to its free cash flow per share. Free cash flow is a key indicator of a company’s financial health, and a lower P/FCF ratio may indicate better value.

- Dividend Payout Ratio: This ratio measures the percentage of earnings paid out as dividends. A lower dividend payout ratio suggests that the company has room to increase dividends or reinvest in the business.

- Return on Equity (ROE): A higher ROE indicates better management of shareholder resources.

- Current Ratio and Quick Ratio: These are liquidity ratios evaluate a company’s ability to meet its short-term obligations. A current ratio above 1 and a quick ratio (or acid-test ratio) close to 1 are positive signs.

- Operating Margin and Net Margin: These margins indicate a company’s profitability. A consistent and healthy operating margin and net margin are important factors to consider.

- Price-to-Cash Flow (P/CF) Ratio: The P/CF ratio compares the stock’s market price to its cash flow per share. This metric offers insight into a company’s cash-generating ability.

- Debt-to-Asset Ratio: This ratio measures the level of debt relative to a company’s total assets. A lower debt-to-asset ratio indicates a more conservative capital structure.

- Book Value per Share: A stock trading below its book value may be considered undervalued.

- Price-to-Earnings-to-Growth (PEG) Ratio: A PEG ratio less than 1 is often considered favorable.

Step 4: Fundamental Analysis

- Examine the company’s financial statements, including the income statement, balance sheet, and cash flow statement, to evaluate its financial performance, profitability, and stability.

- Analyze the company’s growth prospects, competitive advantages, and market positioning.

- Investigate the quality and track record of the management team.

Step 5: Qualitative Analysis

- Study the industry and market conditions in which the company operates.

- Assess potential risks and competitive pressures.

- Consider factors like the company’s reputation, brand strength, and innovation potential.

Step 6: Calculate Intrinsic Value

Use advanced methods like discounted cash flow (DCF) analysis to estimate the intrinsic value of the stock based on expected future cash flows. Compare this intrinsic value to the current stock price to determine if the stock is undervalued.

Step 7: Risk Assessment

- Identify potential risks and uncertainties that could impact the company’s future performance.

- Consider macroeconomic factors that may affect the industry and market.

Step 8: Select Your Stocks

- Based on your analysis, select stocks that meet your value investing criteria.

- Construct a diversified portfolio to spread risk and optimize potential returns.

Online Tools and Softwares

Having a value investing strategy is good, but better if combined with these very useful tools:

- Stock Screeners: Online platforms like Finviz, Yahoo Finance, and StockFetcher offer stock screening capabilities based on various financial and fundamental parameters.

- Financial Statement Analysis Tools: Websites such as Morningstar and Google Finance provide access to company financial statements and data.

- Stock Valuation Calculators: Platforms like GuruFocus and Investing.com offer stock valuation calculators, including discounted cash flow (DCF) models.

- Financial News and Analysis Websites: Access sites like Bloomberg, and MarketWatch for real-time market news and in-depth stock analysis.

- Brokerage Platforms: Many online brokerage firms provide comprehensive research and analysis tools, along with stock screeners, to assist investors in their stock selection process. (Like Degiro or Interactive Brokers)

Advanced Value Investing Strategies

There are 2 more advanced value investing strategies, that I want to share with you; and are: “Deep Value Investing and Contraria Investing”.

Deep Value Investing:

Deep Value Investing is an advanced value investing strategy that involves searching for stocks that are not only undervalued but are deeply undervalued. This strategy often involves investing in companies that are temporarily distressed or facing significant challenges but are trading well below their intrinsic value.

The key principles of deep value investing include:

- Focus on Price-to-Value Ratio: Deep value investors look for stocks with extremely low price-to-value ratios.

- Risk Tolerance: Deep value investors tend to have a higher risk tolerance.

- Margin of Safety: This strategy emphasizes a significant margin of safety. (MOS>50%)

- Active Turnaround or Catalysts: Investors may look for companies that have a clear path to recovery or catalysts that could trigger a positive market reevaluation.

- Patience: Deep value investing requires patience.

- Contrarian Mindset: Deep value investing often aligns with contrarian investing, as it involves going against the crowd, so the prevailing market sentiment.

Here is a valuable book to learn more about this strategy:

- “Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations” by Tobias E. Carlisle

Contrarian Investing:

Contrarian Investing is another advanced value investing strategy, the investor using this strategy, go against the herd and make investment decisions that are opposite to what people believe.

The key principles of contrarian investing include:

- Buy Low, Sell High: Contrarian investors look for assets that are undervalued or out of favor with the market, expecting that they will eventually rise in value.

- Emotion Control: Contrarians need to control their emotions and have conviction in their decisions, even when the majority of investors are on the opposite side.

- Fundamental Analysis: Contrarian investors often search stocks with strong fundamentals that are temporarily unappreciated.

- Long-Term Perspective: Contrarian investing typically has a long-term perspective.

- Value Averaging: Instead of dollar-cost averaging, contrarians may practice “value averaging,” where they buy more of an asset when its price falls and less when it rises.

- Independent Thinking: Contrarian investors are willing to go against popular trends and beliefs.

Both are advanced strategies that require a deep understanding of the market, a strong stomach for volatility, and a willingness to be patient.

They can be rewarding for those who successfully identify undervalued opportunities and have the discipline to stick to their strategy. However, they are not without risks, and diligent research and analysis are essential when implementing these strategies.

Here is a valuable book to learn more about this strategy:

- “Contrarian Investment Strategies: The Psychological Edge” by David Dreman

How many value investing strategies are there ?

There are several value investing strategies, each with its own approach and principles. Here are some of the most common value investing strategies:

- Benjamin Graham’s Value Investing: This is the foundational value investing strategy. It involves buying stocks that are trading below their intrinsic value.

- Deep Value Investing: Investors often focus on distressed or neglected companies.

- Contrarian Investing: Contrarian investors go against the crowd and buy assets that are out of favor with the market.

- Dividend Value Investing: Investors search companies with a history of paying dividends and strong fundamentals.

- Margin of Safety Investing: Benjamin Graham emphasized the importance of a “margin of safety” (MOS), which means you buy stocks at a significant discount to their intrinsic value to protect against potential losses.

- Quality Value Investing: This strategy focus not only on undervalued stocks but also on high-quality companies with strong financials, competitive advantages, and solid management.

- Growth at a Reasonable Price (GARP): Investors search stocks with reasonable growth potential at an attractive price.

- Special Situation Investing: This strategy involves investing in companies undergoing specific events, such as mergers, acquisitions, bankruptcies, or spin-offs. The goal is to profit from these unique situations.

- Small-Cap Value Investing: Investors target smaller companies with strong value characteristics.

- Net-Net Investing: This is a deep value strategy where investors look for stocks trading below their net current asset value (current assets – total liabilities).

- Cigar Butt Investing: This strategy, also from Benjamin Graham, involves buying stocks that have a little “puff” left in them but are selling at a low price.

- Magic Formula Investing: Popularized by Joel Greenblatt, this strategy combines value and quality by ranking stocks based on their return on capital and earnings yield.

- Quantitative Value Investing: Quantitative value strategies use data and quantitative models to identify undervalued stocks.

- Modern Value Investing: Incorporates more modern financial and data analysis techniques to assess value, often using software and algorithms.

It’s important to note that each strategy may have different criteria, time horizons, and levels of risk.

Successful value investors often adapt and combine these strategies.

Mistakes to Avoid

Here’s a list of the common mistakes, that both beginner and expert make when engaging in value investing:

- Ignoring Quality

- Ignoring Market Trends

- Impatience

- Misinterpreting Value Traps

- Ignoring Debt

- Chasing Yield

- Letting Emotions Rule

- Overemphasizing Historical Data

- Relying Solely on Ratios

- Dismissing Technological Changes

- Focusing Only on Large-Cap Stocks

- Ignoring Geopolitical Risks

- Short-Term Thinking

- Following the Herd

- Chasing Hot Sectors

- Ignoring Earnings Quality

- Being Overly Optimistic

- Being Overly Pessimistic

- Failing to Learn from Mistakes

- Overtrading

- Holding Losing Positions Indefinitely

- Lack of Exit Strategy

- Blindly Trusting Analyst Recommendations

- Not Accounting for Inflation

- Focusing Exclusively on Dividends

- Letting Fear Drive Investment Decisions

I hope that you will stay away from this mistakes if you want to imrove the quality of your value investing strategy .

Final Thoughts

Here are some highly recommended books, on the topic of value investing strategy that you can read. These books cover a wide range of value investing topics, from the foundational principles to more advanced strategies.

- “The Intelligent Investor” by Benjamin Graham

- “The Dhandho Investor: The Low-Risk Value Method to High Returns” by Mohnish Pabrai

- “Value Investing: From Graham to Buffett and Beyond” by Bruce C. N. Greenwald, Judd Kahn, Paul D. Sonkin, and Michael van Biema

- “The Warren Buffett Way” by Robert G. Hagstrom

- “The Art of Value Investing: How the World’s Best Investors Beat the Market“ by John Heins and Whitney Tilson

Recent Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- IPO Explained : How to Start the Right WayIPO explained simply. Ever thought about how companies go from being private to being in the stock market spotlight? It’s through something called an Initial Public Offering, or IPO. It’s like a big debut for companies, with lots of potential…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Penny Stocks vs Crypto : What is the Best Solution ?In this exploration of Penny Stocks vs. Crypto, we will delve into the heart of these investment choices. Penny Stocks and Cryptocurrencies, each of these asset classes carries its own unique set of promises and perils, offering the potential for…