The Best Crypto Mining Profitability Calculator of 2023

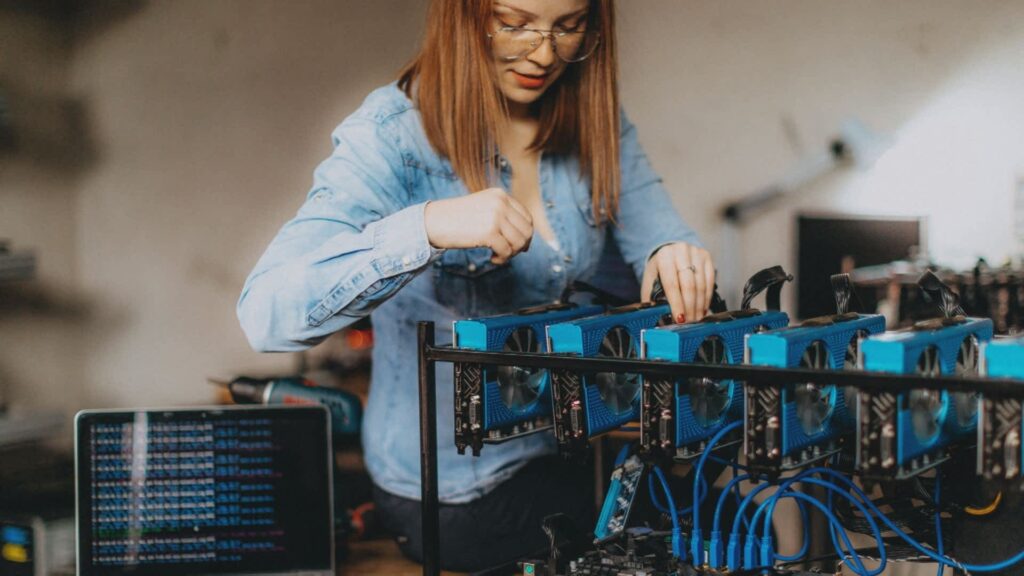

Crypto mining profitability calculator is the compass that guides miners through the often turbulent waters of uncertainty. These calculators aren’t just optional gadgets; they are the keys to unlock the full potential of your mining operation.

To succeed in this landscape, having the right tools at your disposal is not just advantageous – it’s absolutely essential. This is where crypto mining profitability calculators step into the limelight.

Crypto Mining Profitability Calculator

What is a Mining Profitability Calculator and Why is it Essential?

A mining profitability calculator is a digital tool designed to help cryptocurrency miners, both beginners and experienced, assess the potential profitability of their mining endeavors. These calculators are essential resources that offer precise insights into potential earnings, aiding miners in making well-informed decisions about their mining operations.

The Crucial Role of Crypto Mining Profitability Calculators:

These calculators enable miners to estimate their potential earnings and make strategic decisions in the following ways:

1. Earnings Estimation: Mining profitability calculators provide miners with estimates of how much they can potentially earn by mining specific cryptocurrencies.

2. Risk Management: Cryptocurrency mining involves various risks, including hardware investment, energy costs, and market volatility. This calculators, help miners understand and mitigate these risks by allowing to assess the profitability of mining in different scenarios and under varying market conditions.

3. Hardware Optimization: Calculators consider factors like hash rate, power consumption, and initial hardware investment. This data helps miners choose the most suitable and efficient mining equipment .

4. Electricity Costs: Electricity expenses can significantly impact mining profitability. Mining profitability calculators incorporate electricity costs to show miners how this factor affects their potential earnings and help them manage their energy consumption.

5. Coin Selection: Different cryptocurrencies have varying levels of mining difficulty and reward structures. These calculators enable miners to assess the profitability of mining various coins. (So you can choose the most lucrative options)

In summary, mining profitability calculators are indispensable tools for both beginners and experienced miners. They offer insights into potential earnings, facilitate risk management, aid in hardware optimization, and help miners make well-informed decisions.

Key Metrics and Factors

A crypto mining profitability calculator take into account several metrics and factors that have a substantial impact on a miner’s potential earnings and the overall success of their mining operation.

Here’s an explanation of these factors and their real-world implications:

- Hash Rate:

- Hash rate indicates how many calculations a mining device can perform per second. A higher hash rate signifies more computational power.

- For example, if Miner A has a hash rate of 100 MH/s (megahashes per second) and Miner B has a hash rate of 50 MH/s, Miner A is likely to earn twice as much in the same amount of time due to their superior computational capacity.

- Electricity Cost:

- Electricity cost represents the amount spent on electricity to power and cool mining equipment during the mining process. It’s often measured in kilowatt-hours (kWh).

- The higher the electricity cost, the more it eats into potential profits.

- Hardware Costs and Performance:

- Crypto mining profitability calculators consider the cost of acquiring mining hardware and its performance characteristics.

- Mining hardware plays a crucial role in determining profitability. For instance, a more powerful and energy-efficient mining rig may cost more upfront but can result in higher long-term profits due to its superior performance and lower operating expenses.

- Mining Duration:

- Mining profitability calculators factor in the expected duration of mining, or how long a miner intends to keep their hardware running. This helps in estimating long-term profitability and return on investment (ROI).

- The longer a miner runs their hardware, the more they can potentially earn.

- Power Consumption:

- Power consumption represents the electricity used by mining hardware to operate.

- High power consumption can significantly reduce a miner’s profitability, especially in regions with expensive electricity.

Final Thoughts

If you want to use one of these our calculators, check this links:

- The Best Free Compound Interest Calculator (CIC)

- Best Return on Investment Calculator (ROI) Free to Use

- The Best Free Inflation Calculator to Use

- The Best Free Savings Calculator of 2023

- Profit Loss Calculator: Best Free to Use

If you don’t know what crypto mining computer to buy, check our post:

or

Some useful websites that offer a good cryptocurrency mining profitability calculator are:

FAQs

Profitability calculators allow you to assess various scenarios, helping you understand potential risks and how they might impact your earnings. This empowers you to make informed decisions to mitigate these risks.

Calculators incorporate your electricity costs by allowing you to input the cost per kilowatt-hour (kWh) that you pay. This information helps the calculator estimate your ongoing expenses accurately.

No, profitability calculators are designed for miners of all levels of experience, from beginners to experts.

es, profitability calculators are valuable for selecting the most suitable mining hardware. They consider factors like hash rate, power consumption, and initial investment to guide your hardware choices.

Recent Posts

- Stablecoin vs Fiat Currency : Who Win This Great Debate ?In the ongoing debate of Stablecoin vs Fiat, as the global economy transforms, questions arise about the roles these currencies play in shaping our financial future. This exploration dives into the core of the debate, highlighting the differences, benefits, and…

- IPO Explained : How to Start the Right WayIPO explained simply. Ever thought about how companies go from being private to being in the stock market spotlight? It’s through something called an Initial Public Offering, or IPO. It’s like a big debut for companies, with lots of potential…

- Trading vs Investing : Wich is the Better Solution?In the world of money, deciding between trading vs investing is a big deal. It’s like choosing a path that will seriously affect your financial future. Trading and investing are different ways to handle your money, and the choice you…

- What is the Most Secure Stablecoin of 2023 ?We’ll take a deep dive into the world of stablecoins, exploring their types, evaluating criteria for security, and identifying the most secure stablecoin. The cryptocurrency market is in constant evolution and with new players entering the scene, security has become…

- Penny Stocks vs Crypto : What is the Best Solution ?In this exploration of Penny Stocks vs. Crypto, we will delve into the heart of these investment choices. Penny Stocks and Cryptocurrencies, each of these asset classes carries its own unique set of promises and perils, offering the potential for…