Best Return on Investment Calculator (ROI) Free to Use

Our user-friendly Return on Investment Calculator is designed to simplify the calculation process and provide you with precise results in no time.

Return on Investment (ROI) Calculator

How to Use the Calculator ?

Follow this step-by-step guide to effectively use the calculator for all your ROI calculations:

- Enter the Initial Investment:

- Input the initial amount you invested in the “Amount Invested” field. (This is the money you initially put into the investment)

- Enter the Amount Returned:

- In the “Amount Returned” field, specify the total gains or profits you’ve earned from the investment.

- Set the Investment Timeframe – From and To:

- Define the duration over which your investment has been active. (Input the start date in the “Investment Time – From” field and the end date in the “Investment Time – To” field. These dates determine the timeframe over which you’re calculating ROI)

- Click “Calculate”:

- Once you’ve entered the initial investment, amount returned, and the investment timeframe, click the “Calculate” button.

- View the ROI Result:

- The calculator will instantly process the data and provide you with the Return on Investment (ROI) percentage.

- Interpret the Result:

- A positive ROI indicates that your investment has been profitable, while a negative ROI signifies losses. (The ROI percentage helps you evaluate the performance of your investment)

What Is ROI?

Return on Investment (ROI) is a fundamental financial metric used to evaluate the profitability and efficiency of an investment, be it in a business, project, or financial asset.

It quantifies the return or gain generated from an investment in relation to its initial cost.

Key Components of ROI:

- Initial Investment (Cost): ROI begins with the initial capital outlay, representing the amount of money invested. This includes expenses such as purchasing assets, undertaking projects, or launching marketing campaigns.

- Returns (Gains): Returns encompass the profits, income, or benefits generated from the investment. These can result from various sources, including sales revenue, rent, interest, or cost savings.

- Timeframe: The period over which the investment is assessed is a crucial element in ROI calculation. It establishes the duration for which returns are evaluated.

ROI Calculation:

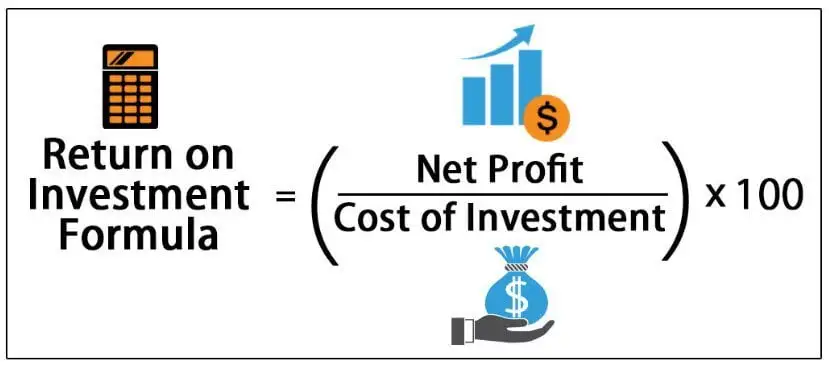

The formula for ROI is relatively simple:

ROI = (Net Gain from Investment / Initial Investment) x 100

Here’s how the calculation works:

- Subtract the initial investment (cost) from the total returns (gains) to find the net gain from the investment.

- Divide the net gain by the initial investment to determine the proportion of gain relative to the cost.

- Multiply this proportion by 100 to express ROI as a percentage.

Interpreting ROI:

- Positive ROI: Remember that a value greater than zero (+0) indicates that the investment has generated profit. (The higher the positive ROI, the more lucrative the investment)

- Negative ROI: A value less than zero (-0) implies a loss on the investment. (The larger the negative ROI, the bigger the loss)

Why ROI Matters ?

ROI is essential for these 5 key reasons:

- Decision-Making: ROI aids in making informed decisions about where to allocate resources. It helps prioritize investments that promise the highest returns.

- Performance Evaluation: Businesses and individuals use ROI to evaluate the success of past investments, projects, or strategies.

- Risk Assessment: ROI provides insights into the risk and potential reward associated with an investment.

- Comparative Analysis: It enables the comparison of different investments to identify the most promising ones.

- Continuous Improvement: By tracking the ROI, businesses and investors can refine their strategies and maximize returns over time.

In summary, a return on investment calculator is an essential tool for evaluating investments and reaching your financial goals.

The Challenges of Manual ROI Calculation

Manually calculating Return on Investment (ROI) can be tricky and prone to errors. It works well for simple cases but becomes problematic with complex investments. Here are the main issues with doing ROI calculations by hand:

- Complex Formulas: ROI calculation often involves complex formulas, especially when considering factors such as compounding and multiple cash flows.

- Extensive Data Requirements: Accurate ROI calculation may require extensive data, including initial investment, gains or losses, timeframes, and sometimes, additional data like discount rates. Gathering and organizing this data can be time-consuming.

- Risk of Error: Manual calculations are susceptible to human error, including typographical mistakes or formula misapplication. A single error can lead you to incorrect results.

- Time-Consuming: Manual calculations can be time-consuming, especially when dealing with long investment horizons or a large volume of data points. This time could be better spent on strategic decision-making.

- Sensitivity to Changes: Manual calculations can be sensitive to changes in data, and small errors can lead to significant discrepancies.

- Lack of Real-Time Analysis: Manual calculations typically don’t provide real-time analysis.

- Difficulty with Multiple Investments: When dealing with multiple investments or projects, each with its own ROI calculations, manual tracking and comparison become complex and error-prone.

Because of these difficulties, many people and businesses use automated return on investment calculators.

These tools make calculations easier, lower the chance of mistakes, provide instant analysis, and assist with scenario planning. They offer a more efficient and dependable way to evaluate investment performance and make well-informed choices.

Real-Life Examples

Let’s explore 5 real-life examples and scenarios that demonstrate how to use our ROI calculator for different types of investments.

1. Stock Investment

Scenario: Imagine you’re considering an investment in a company’s stock. You want to assess the ROI for this stock investment.

Step 1: Access the return on investment calculator on our platform.

Step 2: Input your initial investment, let’s say $10,000, in the “Initial Investment” field.

Step 3: If your stock investment generates returns, enter the total gains or profits you’ve earned, e.g., $3,000, in the “Gains or Profits” field. If you haven’t gained yet, you can leave this field at $0.

Step 4: Set the timeframe. If you’ve held the stock for 2 years, input “2” in the “Timeframe” field.

Step 5: Click “Calculate ROI.”

Result: The calculator instantly provides the ROI percentage, which, in this case, might be 30%. This means your stock investment has yielded a 30% return over 2 years.

2. Real Estate Investment

Scenario: You’re considering an investment in a rental property and want to evaluate its ROI.

Step 1: Access the ROI Calculator.

Step 2: Input your initial investment, let’s say $200,000, in the “Initial Investment” field.

Step 3: Enter any gains you’ve earned from the property. If your rental income over a year is $20,000 and you’ve earned $10,000 in property value appreciation, you’d enter $30,000 in the “Gains or Profits” field.

Step 4: Set the timeframe. For this scenario, let’s use 5 years, so input “5” in the “Timeframe” field.

Step 5: Click “Calculate ROI.”

Result: The calculator provides the ROI percentage, which, for this example, might be 15%. This signifies that your real estate investment has generated a 15% return over 5 years.

3. Business Project Investment

Scenario: You’re a business owner looking to assess the ROI of a new marketing campaign.

Step 1: Access the ROI Calculator.

Step 2: Input the campaign’s initial cost, let’s say $50,000, in the “Initial Investment” field.

Step 3: Enter the total gains generated by the campaign. If it resulted in $80,000 in increased revenue, input $80,000 in the “Gains or Profits” field.

Step 4: Set the timeframe. In this case, you’re looking at a 1-year timeframe, so input “1” in the “Timeframe” field.

Step 5: Click “Calculate ROI.”

Result: The calculator provides the ROI percentage, which could be 60%. This means that your marketing campaign has yielded a 60% return in increased revenue over one year.

These real-life examples illustrate how to use our ROI calculator for different investment types. By following these steps, you can make data-driven investment decisions, whether you’re dealing with stocks, real estate, or business projects, and gain valuable insights into their profitability.

4. Small Business Investment

Scenario: You’re a small business owner considering an investment in expanding your product line.

Step 1: Access the ROI Calculator.

Step 2: Input the initial investment amount, let’s say $30,000, in the “Initial Investment” field.

Step 3: Enter the total gains or additional profit you’ve made from the expanded product line. If you’ve earned an extra $15,000 in profit after a year, input $15,000 in the “Gains or Profits” field.

Step 4: Set the timeframe. In this case, you’ve evaluated the investment over 12 months, so input “1” in the “Timeframe” field.

Step 5: Click “Calculate ROI.”

Result: The calculator provides the ROI percentage, which might be 50%. This indicates that your investment in expanding the product line has yielded a 50% return in additional profits over one year.

5. Personal Investment Portfolio

Scenario: As an individual investor, you want to assess the overall ROI for your diversified investment portfolio, which includes stocks, bonds, and real estate.

Step 1: Access the return on investment calculator.

Step 2: Input the total initial investment in your diversified portfolio. Let’s say you’ve invested a total of $100,000.

Step 3: Enter the total gains or losses from your portfolio over a given period. If your portfolio has grown to $120,000, you’ve gained $20,000.

Step 4: Set the timeframe for the investment evaluation. For this example, let’s consider a 3-year timeframe.

Step 5: Click “Calculate ROI.”

Result: The calculator provides the overall ROI percentage, which might be 20%. This signifies that your diversified investment portfolio has generated a 20% return over the specified 3-year period.

Final Thoughts

We invite you to dive deeper into this world and take control of your financial destiny.

Recommended Books: (#Amazon adv)

- “Return on Investment in Training and Performance Improvement Programs“ by Jack J. Phillips and Patricia Pulliam Phillips

- “The Basics of Return on Investment (ROI)“ by David R. Luna

- “ROI For Nonprofits: The New Key to Sustainability“ by Tom Ralser and Tori Green

- “The Entrepreneur’s Guide to Financial Statements” by David Worrell

These books discuss ROI in different areas, from nonprofits to marketing and entrepreneurship. They provide valuable insights for anyone looking to better grasp and enhance their return on investment in various situations.

Explore More Calculators:

In addition to our Return on Investment Calculator, we offer a suite of other calculators designed to simplify complex financial calculations.

Feel free to explore these tools on our platform.

- The Best Free Inflation Calculator to Use

- The Best Free Savings Calculator of 2023

- The Best Crypto Mining Profitability Calculator of 2023

- Profit Loss Calculator: Best Free to Use

Recent Posts

- The Best Etfs You Need In Your Portfolio To SucceedExchange-Traded Funds, or ETFs, offer to us investors a convenient and diversified way to access a wide range of asset classes. Understanding the ETF options available can significantly contribute to your portfolio’s growth and resilience. In this guide, we will…

- The Best Stocks to Buy Now and Hold/span> Choosing the best stocks to buy is not just a financial decision; it’s also a critical step in building your wealth and securing your financial future. In fact, stocks, play a significant role in building substantial wealth over time….

- Becoming Financially Free with the Best BooksImagine you finally financially free and having the knowledge and insights to navigate investments, savings, and money management with confidence and precision. Few resources hold as much potential for shaping one’s future as this best financial books for becoming financially…

- Understand Crypto with the Best Books that You Need NowLet’s dive in and understand the crypto world with the books that you need to read now, that promise to enrich your understanding and guide you toward crypto success. In a world where the crypto landscape evolves at lightning speed,…

- The Best Way to Store Your Crypto InvestmentsIn this digital age, the best way to store your cryptos, are in these 4 safe and secure crypto wallets that, are not just tools; they are your guardians of wealth in the virtual frontier. As you navigate the complexities…

FAQs

What does a negative ROI mean?

A negative ROI signifies that the investment has resulted in a loss. The magnitude of the negative ROI reflects the extent of the loss.

Can ROI be used for various types of investments?

Yes, ROI is a versatile metric used in a wide range of investments, including stocks, real estate, business projects, and more.

How can businesses improve their ROI over time?

Businesses can enhance ROI by refining their strategies, optimizing costs, and focusing on investments with higher potential returns. Regular monitoring and analysis are key.

How does the time frame affect ROI?

The time frame determines the duration over which the investment’s returns are assessed. A longer time frame may lead to a higher ROI due to the compounding effect of returns over time.

How can businesses use ROI to make decisions?

Businesses use ROI to prioritize investments with the highest expected returns, assess the success of past projects, and compare different investment opportunities.

What is the difference between ROI and other financial metrics like ROE (Return on Equity) or ROA (Return on Assets)?

ROI specifically measures the return on a financial investment relative to its cost, while ROE focuses on a company’s profitability concerning shareholders’ equity, and ROA assesses profitability concerning total assets.

What is the role of technology in ROI calculations?

Technology, such as ROI calculators, streamlines and automates the ROI calculation process, reducing errors and providing real-time analysis, making it easier for businesses and individuals to assess their investments.